【美品】ドッグウェル セニング DTF-30

(税込) 送料込み

商品の説明

使用回数10回ほどで、結局元々ある物を使ってたのでこちらはほとんど使っていません。

まだ一度も研ぎにも出してなく顔カットで少し使った程度です。もちろん切れ味は問題ありません。

無料修理サービス1回分とお手入れセットお付けします。

とても人気のモデルなので中古ですが美品ですので少しでもお安く手に入れたい方にお譲りします。

買った時の箱に入れて丁寧に梱包し発送させて頂きます。

定価¥74800(今はもっと値上がりしてます…)

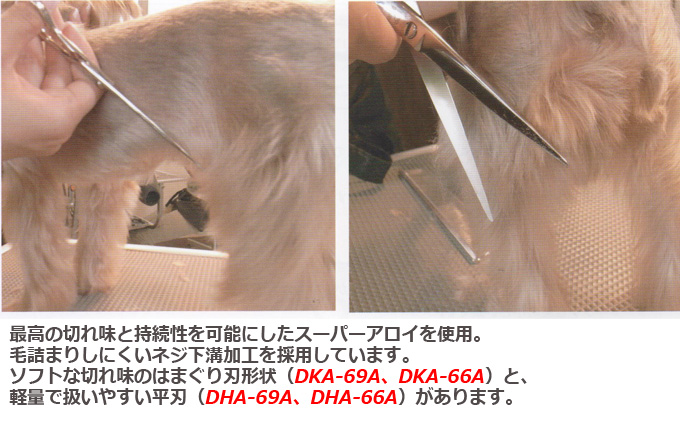

ドッグウェルセニングDTF-30

全長166㎜

サイズ5.9インチ

刃渡61㎜

30目生刃

カット率35~40%

調整自在ネジ

【無料修理サービスと純正のお手入れセット付き】

取りきれない細かい毛が付いています。

美品ですがあくまで中古ですので完璧を求める方はご遠慮下さい。

用品の種類···お手入れ・トリミング用品商品の情報

| カテゴリー | その他 > ペット用品 > 犬用品 |

|---|---|

| 商品の状態 | 目立った傷や汚れなし |

ドッグウェル】DTF-30 | ジョーウェル公式WEBショップ | JOEWELL WEB SHOP

楽天市場】トリミングシザー 東光舎 DOGWELL ドッグウェル DTF-30

楽天市場】トリミングシザー 東光舎 DOGWELL ドッグウェル DTF-30

美品】ドッグウェル セニング DTF-30 春のコレクション alfboss.com

ドッグウェル DOGWELL DTF-30 セニング - 犬用品

ドッグウェルペット専門シザーズ

DOGWELL セニングシザーズ | ジョーウェル・シザーズ

大人も着やすいシンプルファッション トリミングシザー ドッグウェル 6

楽天市場】トリミングシザー 東光舎 DOGWELL ドッグウェル DTF-30

美品】ドッグウェル セニング DTF-30 春のコレクション alfboss.com

ドッグウェル DOGWELL DTF-30 セニング - 犬用品

楽天市場】トリミングシザー 東光舎 DOGWELL ドッグウェル DTF-30

JOEWELL ジョウエル セニングシザー KT-40 東光舎 犬-

JOEWELL ジョウエル セニングシザー KT-40 東光舎 犬-

楽天市場】トリミングシザー 東光舎 DOGWELL ドッグウェル DTF-30

DOGWELL DTF-30 ドッグウェル シザー セニング - ペット用品

ドッグウェルペット専門シザーズ

楽天市場】トリミングシザー 東光舎 DOGWELL ドッグウェル DTF-30

東光舎 ドッグウェル・ジョーウェル|ペット用品の販売と通販

dogwell | ペット用品の卸専門店 Buddy Snatch(ばでぃー すなっち)

東光舎ドッグウェル(DOGWELL)商品一覧まとめ 鋏研ぎ師のお店 ハサミ

楽天市場】トリミングシザー 東光舎 DOGWELL ドッグウェル DTF-30

東光舎 ドッグウェル・ジョーウェル|ペット用品の販売と通販

JOEWELL ジョウエル セニングシザー KT-40 東光舎 犬-

東光舎 ドッグウェル・ジョーウェル|ペット用品の販売と通販

美品】ドッグウェル セニング DTF-30 熱販売 musi-co.com

東光舎 ドッグウェル・ジョーウェル|ペット用品の販売と通販

東光舎ドッグウェル(DOGWELL)商品一覧まとめ 鋏研ぎ師のお店 ハサミ

人気第6位 ドッグウェル トリミングシザー DKM-68 その他 raino.co.in

カーブセニングシザーカーブブレンディングシザートリミングペット

東光舎 ドッグウェル・ジョーウェル|ペット用品の販売と通販

シルバーライン ゴールドパンパン鋏 非常に高い品質 alfboss.com

楽天市場】トリミングシザー 東光舎 DOGWELL ドッグウェル DTF-30

大人も着やすいシンプルファッション トリミングシザー ドッグウェル 6

ドッグウェルペット専門シザーズ

ドッグウェル DOGWELL DTF-30 セニング - 犬用品

東光舎 ドッグウェル・ジョーウェル|ペット用品の販売と通販

ニックスキハサミ30目セニング+spbgp44.ru

ニックスキハサミ30目セニング+spbgp44.ru

ドッグウェル シザー スキ鋏 DTF-40 カット率約35%プロ仕様 犬

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています