ドラゴンボールカードダス

(税込) 送料込み

商品の説明

大事に保管してました。

宜しくお願いしますm(_ _)m

返品、キャンセルはお受け出来ませんのでご了承くださいm(_ _)m商品の情報

| カテゴリー | おもちゃ・ホビー・グッズ > コレクション > その他 |

|---|---|

| 商品の状態 | 目立った傷や汚れなし |

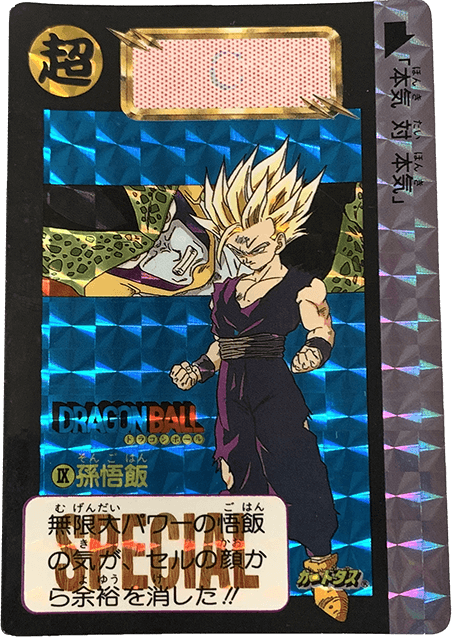

ドラゴンボール カードダス リミックス Vol.1 | ドラゴンボール

カードダス ドラゴンボール - ドラゴンボール

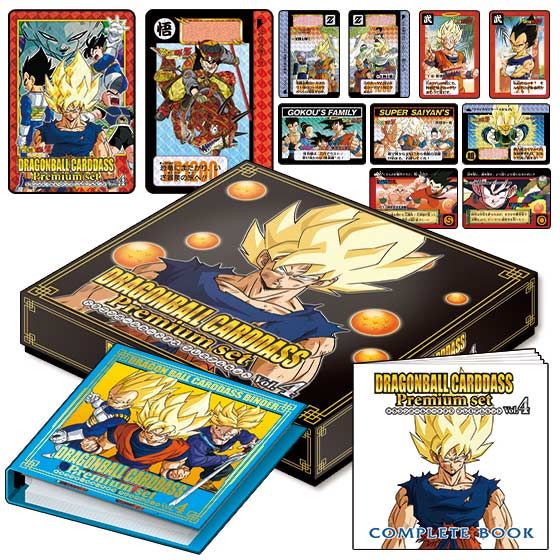

ドラゴンボールカードダス Premium set Vol.4 | ドラゴンボール

カードダス ドラゴンボール スーパーバトル Premium set Vol.5

抽選販売】カードダス30周年記念 ベストセレクションセット

ドラゴンボール カードダス スーパーバトル 15弾&16弾コンプ

ドラゴンボールカードダス ファイル&カードセット

ドラゴンボールが四半世紀以上愛されるワケ。~カードダスの裏側を聞い

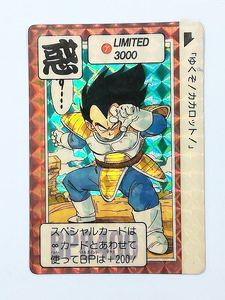

ドラゴンボール カードダス LIMITED 3000 Are You Ready 定番の中古

カードダス ドラゴンボール

ドラゴンボールカードダス Premium set Vol.7...|WebShopびーだま

ドラゴンボールカードダス 海外 ベジータ 孫悟空 セットの通販 レイジ

抽選販売】ドラゴンボールカードダス【映画ドラゴンボール超 ブロリー

カードダスドットコム 公式サイト | 商品情報 - ドラゴンボール

カードダス」超高額買取ベスト30を公開! 1回100円のカードがいまや25

抽選販売】ドラゴンボールカードダス 【激闘!!復讐者と絶対神】33弾

ミニミニカードダス ドラゴンボールカードダス|ガシャポン

Yahoo!オークション - ドラゴンボールZカードダス スーパーバトル第16

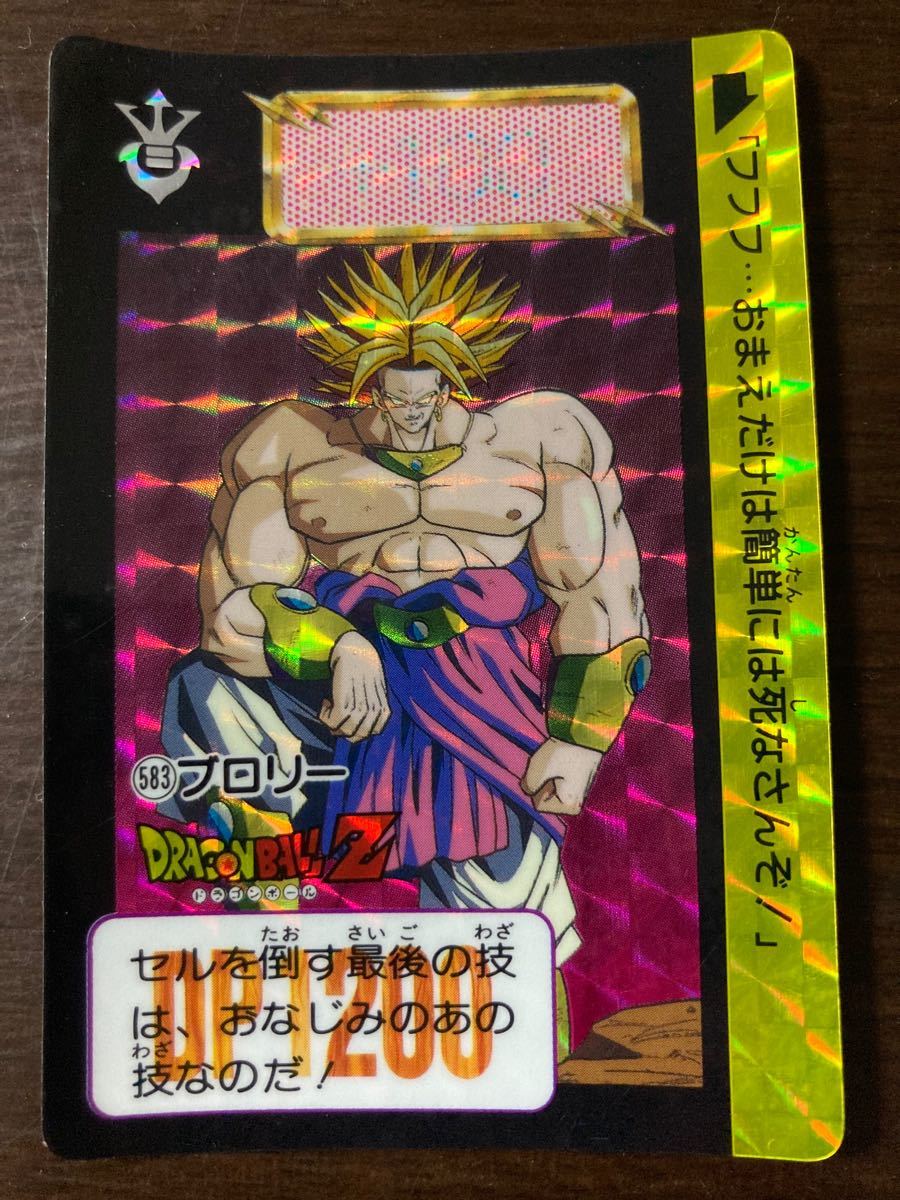

ドラゴンボール カードダス バンダイ 本弾 583ブロリー|Yahoo!フリマ

ドラゴンボールカードダス

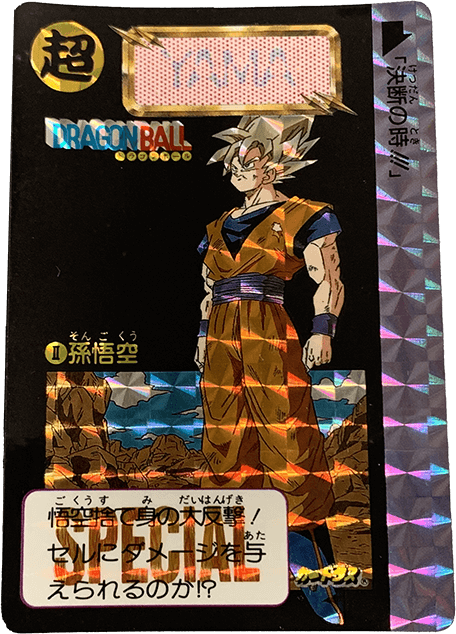

ドラゴンボール/カードダス/孫悟空/499-

ドラゴンボールカードダス買取価格表|ヴィントコレクト

ドラゴンボールカードダス Premium set Vol.3...|WebShopびーだま

35周年記念カードダスミニ自販機 ドラゴンボール | ドラゴンボール

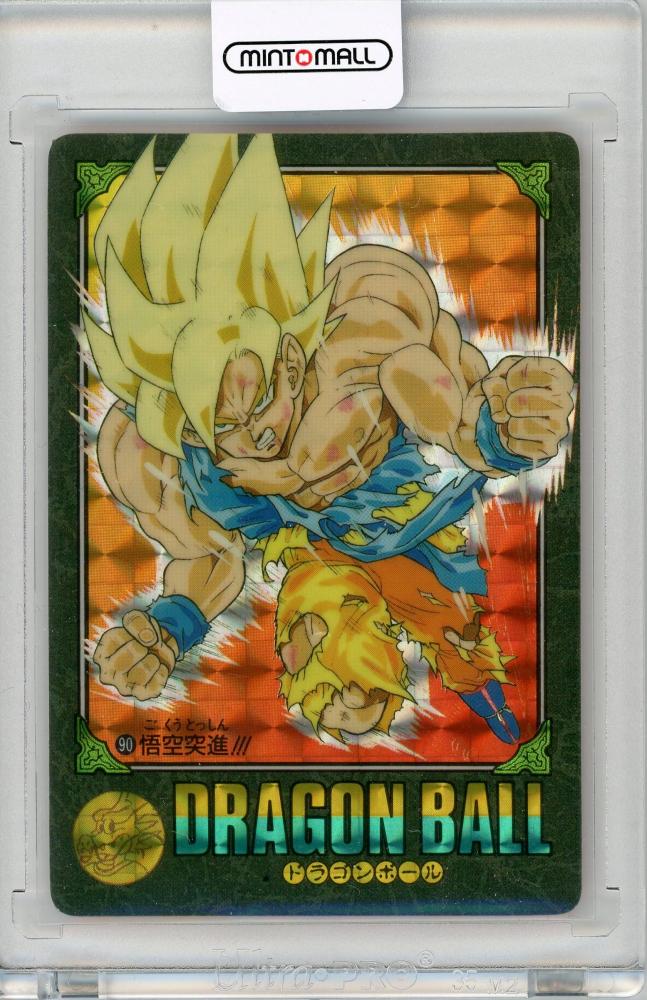

ミントモール / MINT 札幌店 / ドラゴンボールカードダス ビジュアル

カードダスドットコム 公式サイト | 商品情報 - ドラゴンボール

ドラゴンボール カードダス 本弾17弾 キラコンプ

Amazon.co.jp: ドラゴンボールカードダス

ドラゴンボール カードダス ダブル 1番 初版 オリジナル - カード

ドラゴンボール カードダス ドラゴンボール | www.vinoflix.com

20億枚売り上げたドラゴンボールカードダスが復刻!18年ぶりの新カード

ドラゴンボールカードダス買取価格表|ヴィントコレクト

ドラゴンボール データカードダス プラスチック ドラゴンボール | www

ドラゴンボール:カードダス第1~4弾の全168種がセットに 新規カードも

カードダスドットコム 公式サイト | 商品情報 - ドラゴンボール

ミニミニカードダス ドラゴンボールカードダス|ガシャポン

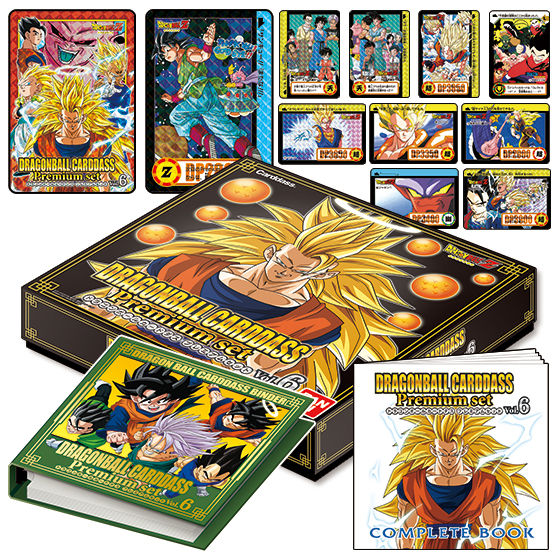

再販】ドラゴンボールカードダス Premium set Vol.6 | ドラゴンボール

ドラゴンボールコレクション用カードアルバム ドラゴンボール

BANDAI ドラゴンボールZ ドラゴンボールカードダス3億枚突破記念

ドラゴンボール - 人魚 ドラゴンボール カードダス ガールズ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています