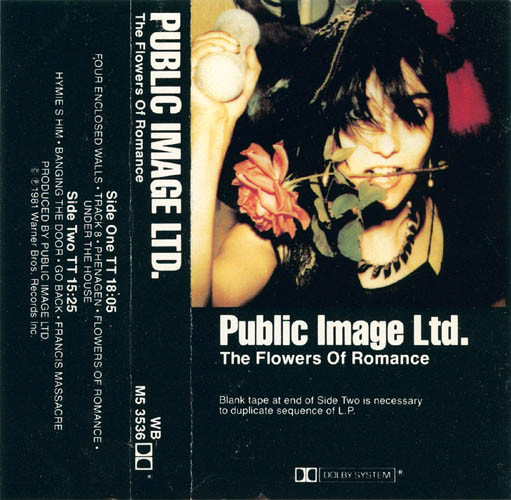

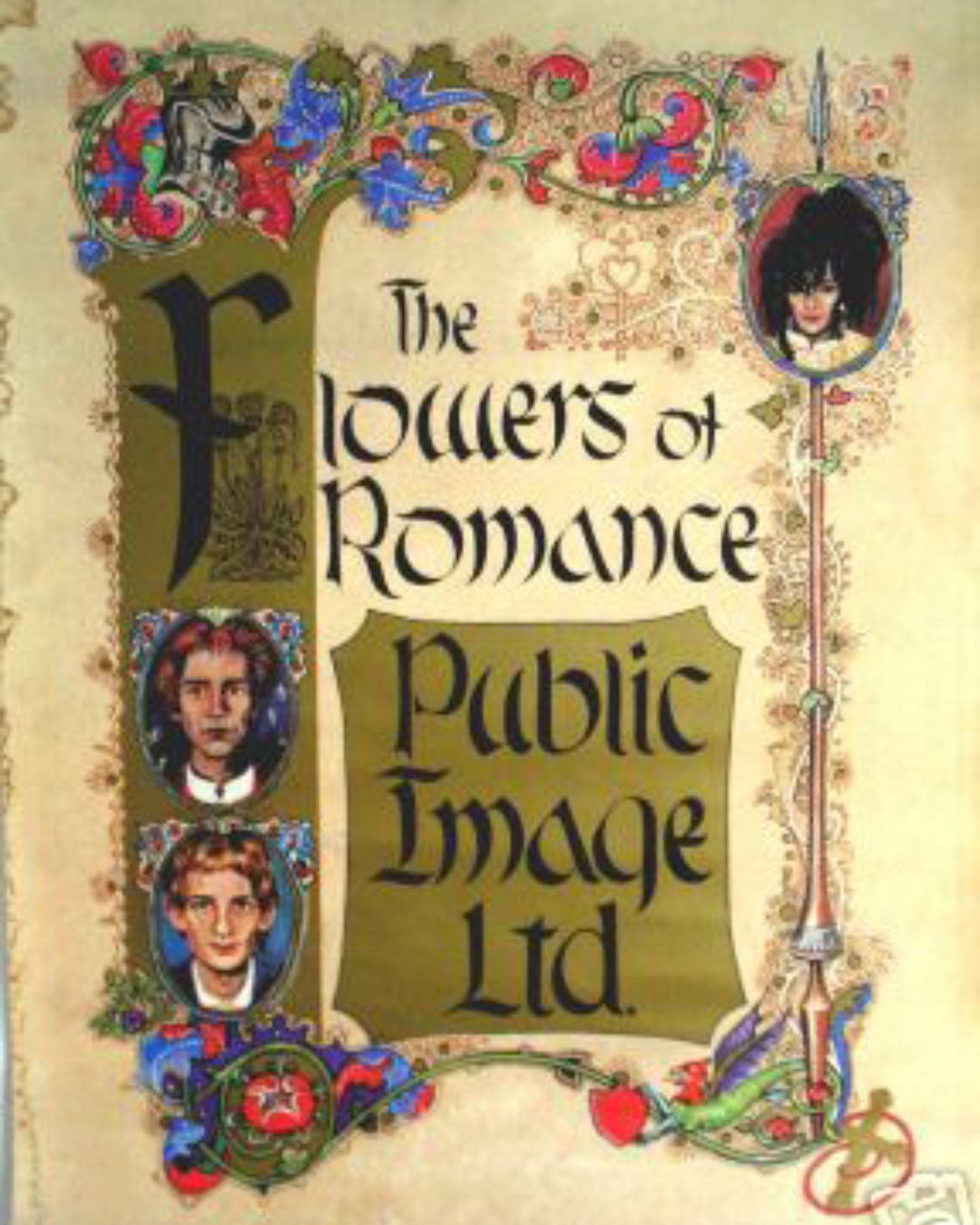

パブリック・イメージ・リミテッド[フラワーズ・オブ・ロマンス]

(税込) 送料込み

商品の説明

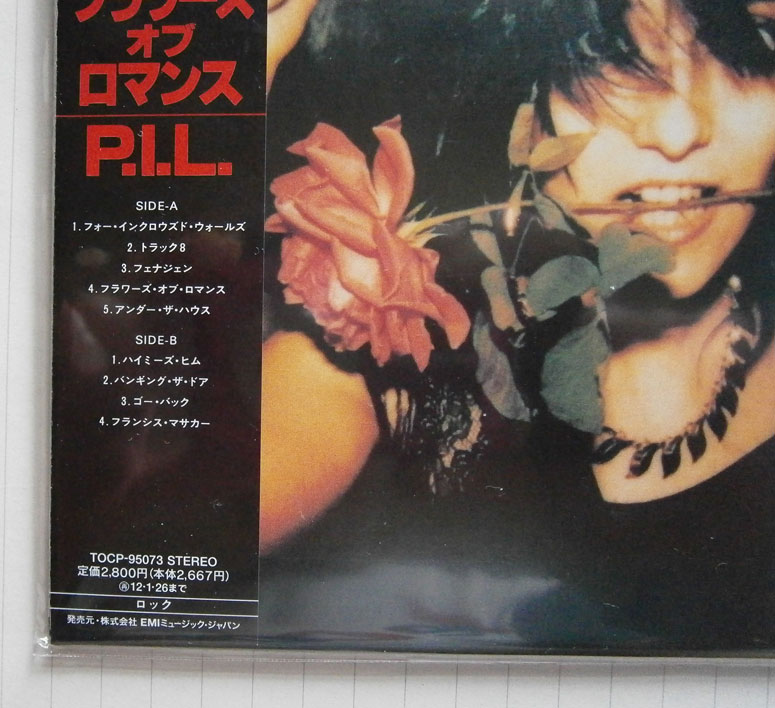

TOCP-95073

*初の紙ジャケット仕様による全オリジナル・アルバム、リリース。

*デジタル・リマスター&SHM-CD仕様。

*完全生産限定盤。商品の情報

| カテゴリー | 本・音楽・ゲーム > CD > 洋楽 |

|---|---|

| 商品の状態 | 新品、未使用 |

![フラワーズ・オブ・ロマンス [紙ジャケ][SA-CD] - パブリック](https://content-jp.umgi.net/products/ui/UIGY-9700_gGc_extralarge.jpg)

フラワーズ・オブ・ロマンス [紙ジャケ][SA-CD] - パブリック

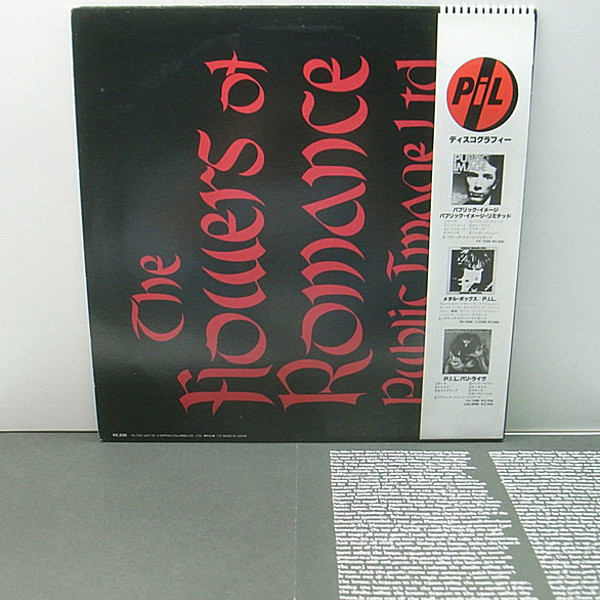

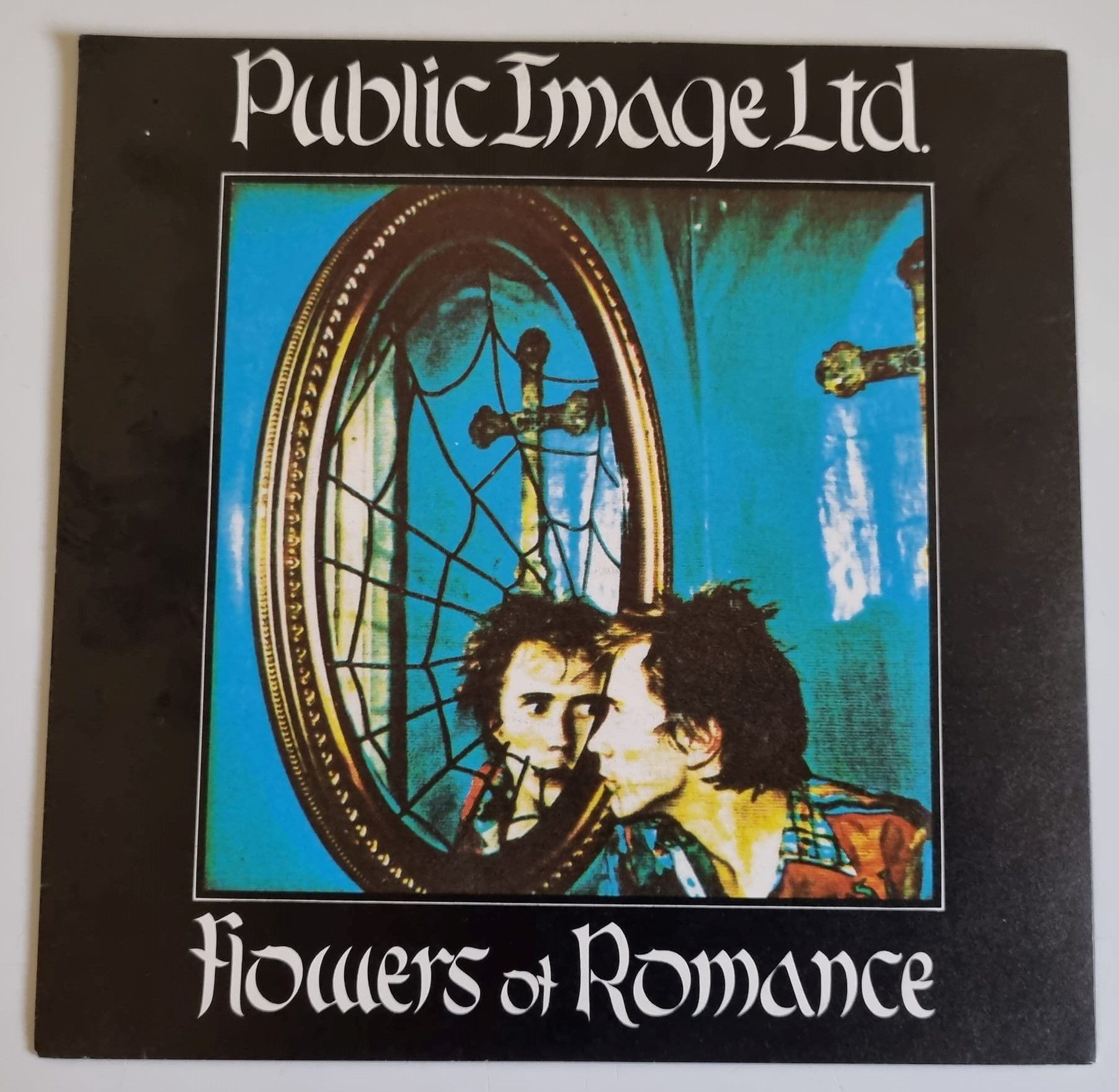

PUBLIC IMAGE LIMITED / The Flowers Of Romance (LP) / Columbia

芽瑠璃堂 > パブリック・イメージ・リミテッド 『フラワーズ・オブ

Public Image Ltd: The Flowers of Romance Album Review | Pitchfork

Public Image Ltd. (PIL) / The Flowers Of Romance - DISK-MARKET

Flowers of Romance (song) - Wikipedia

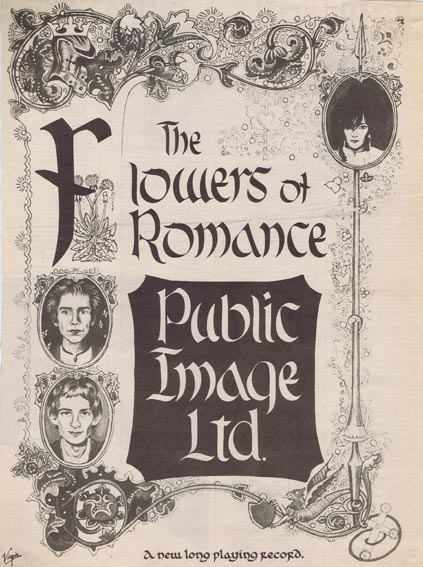

Public Image Limited's groundbreaking 'Flowers Of Romance' is 40

P.I.L. / FLOWERS OF ROMANCE

Public Image Ltd.- Flowers Of Romance

Public Image LTD ( Pil ) - Flowers Of Romance (SHM-CD) - CD

Public Image Limited - The Flowers Of Romance (1981) : Free

PIL... Flowers of Romance... on top of... - Punk In The Loft

THE FLOWERS OF ROMANCE / フラワーズ・オブ・ロマンス/PUBLIC IMAGE

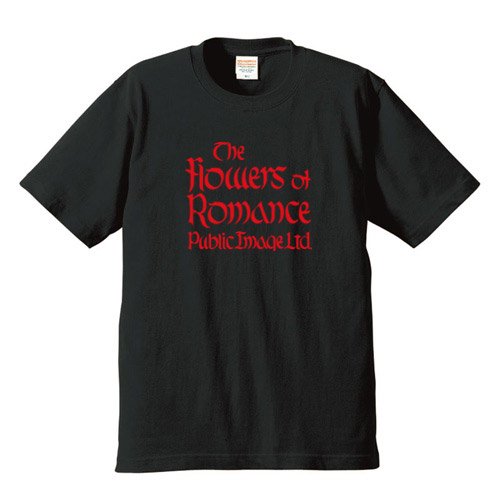

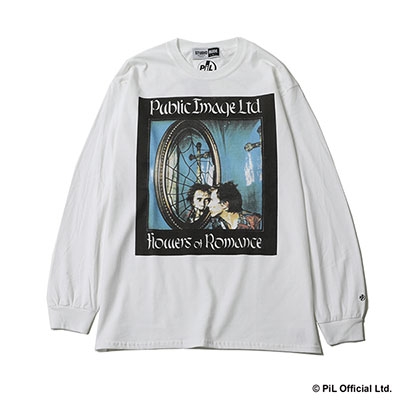

パブリック・イメージ・リミテッド / フラワーズ・オブ・ロマンス (6.2オンス プレミアムTシャツ 4色) - ロックTシャツ バンドTシャツ通販 ブルーラインズ

Public Image Limited (P.I.L.): The Flowers Of Romance (SHM-CD) (CD

P.I.L. / FLOWERS OF ROMANCE

PIL

Public Image Ltd.- The Flowers Of Romance (Top Of The Pops) 1981

PUBLIC IMAGE LIMITED / The Flowers Of Romance (LP) / Columbia

際立つ先鋭性をもったもう一つの作品…P.I.L『フラワーズ・オブ

名盤と私31:Public Image Limited/ Flowers Of Romance | 勝手に

Public Image Ltd on X:

THE FLOWERS OF ROMANCE / フラワーズ・オブ・ロマンス/PUBLIC IMAGE

PUBLIC IMAGE LIMITED / The Flowers Of Romance (LP) / Columbia

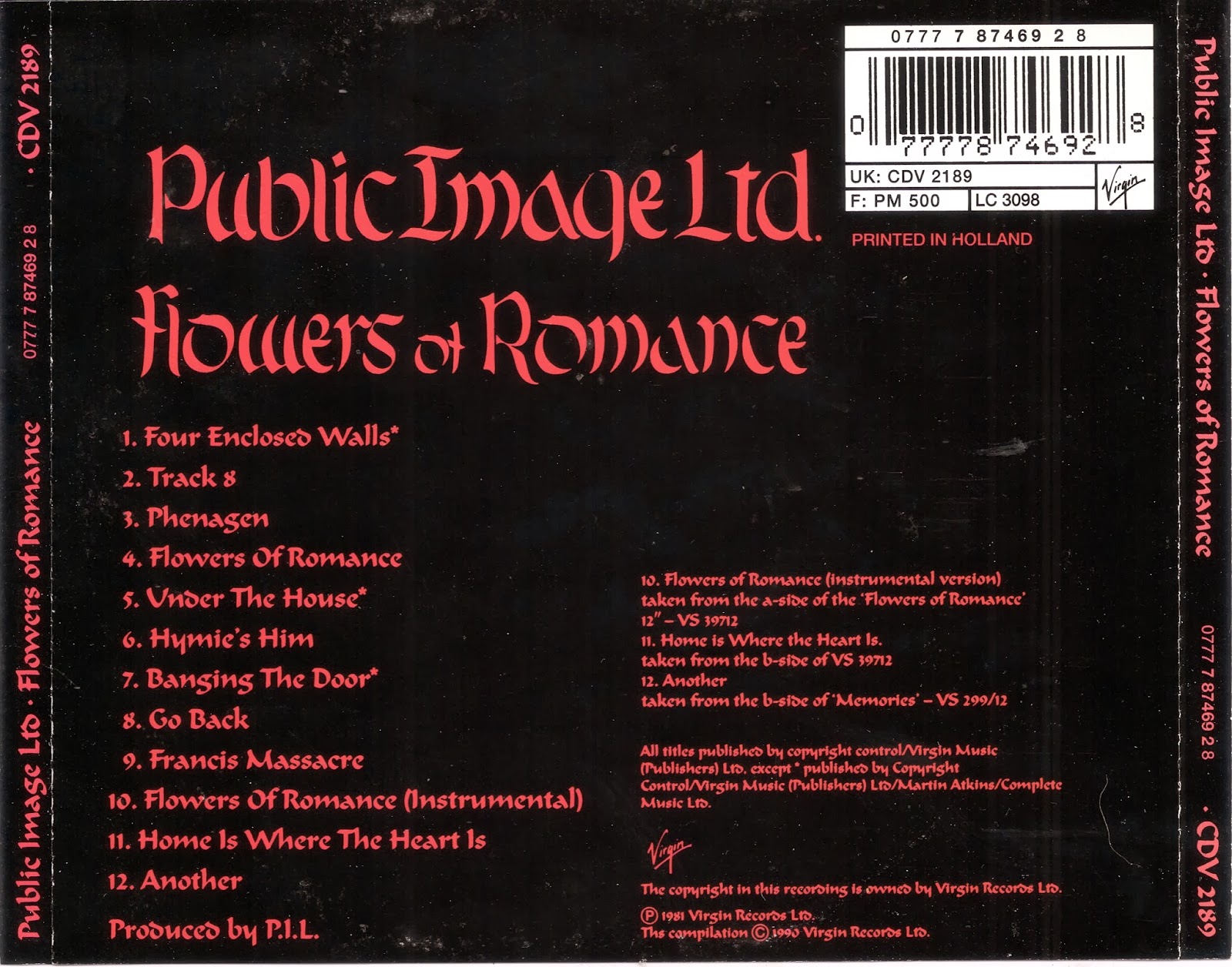

Public Image Ltd. - The Flowers Of Romance | Releases | Discogs

Public Image Ltd./Public Image Ltd. FLOWERS OF ROMANCE LS TEE

![フラワーズ・オブ・ロマンス [SHM-CD][CD] - パブリック・イメージ](https://content-jp.umgi.net/products/ui/UICY-16041_PGL_extralarge.jpg)

フラワーズ・オブ・ロマンス [SHM-CD][CD] - パブリック・イメージ

PIL Flowers of Romance Tシャツ パプリック イメージ リミテッド フラワーズ オブ ロマンス ジョン ライドン ジョニー ロットン バンドT

PUBLIC IMAGE LIMITED / The Flowers Of Romance (LP) / Columbia

P.I.L. - Flowers Of Romance | HERETIC!!!

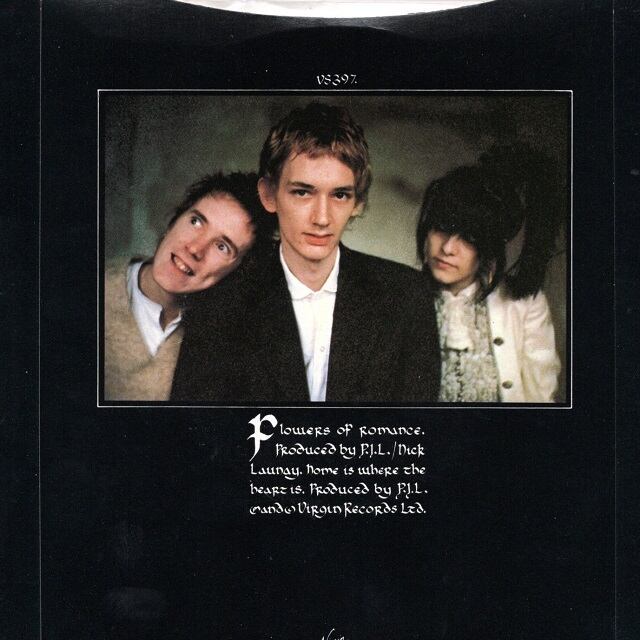

Public Image Ltd (P.I.L.) - Flowers Of Romance (7

BlogRoddus: Public Image Limited - Flowers Of Romance (UK 1981)

Amazon.co.jp: Flowers of Romance: ミュージック

Flowers of Romance by Public Image Ltd (Virgin) | expletive undeleted

Public Image Ltd. – The Flowers Of Romance (1981, Cassette) - Discogs

![Record Review: PiL – The Flowers Of Romance [part 2] | Post-Punk Monk](https://postpunkmonk.files.wordpress.com/2017/05/pil-1981.jpg)

Record Review: PiL – The Flowers Of Romance [part 2] | Post-Punk Monk

7EP】Public Image Limited – Flower Of Romance | マメシバレコード

パブリック・イメージ・リミテッド【PiL】のカタログが再リリース決定

Public Image Ltd on X:

Public Image Ltd. (PIL) / The Flowers Of Romance - DISK-MARKET

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています