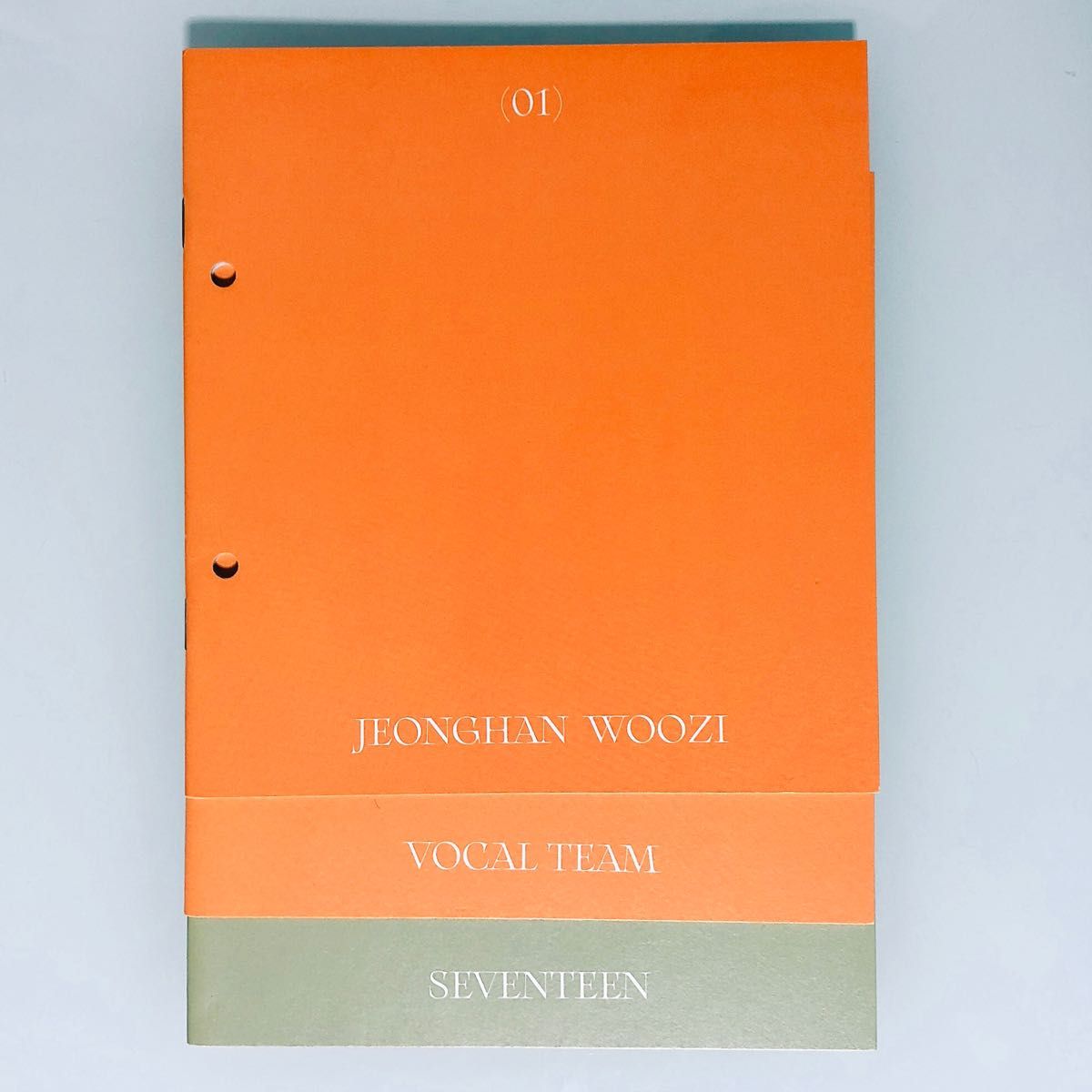

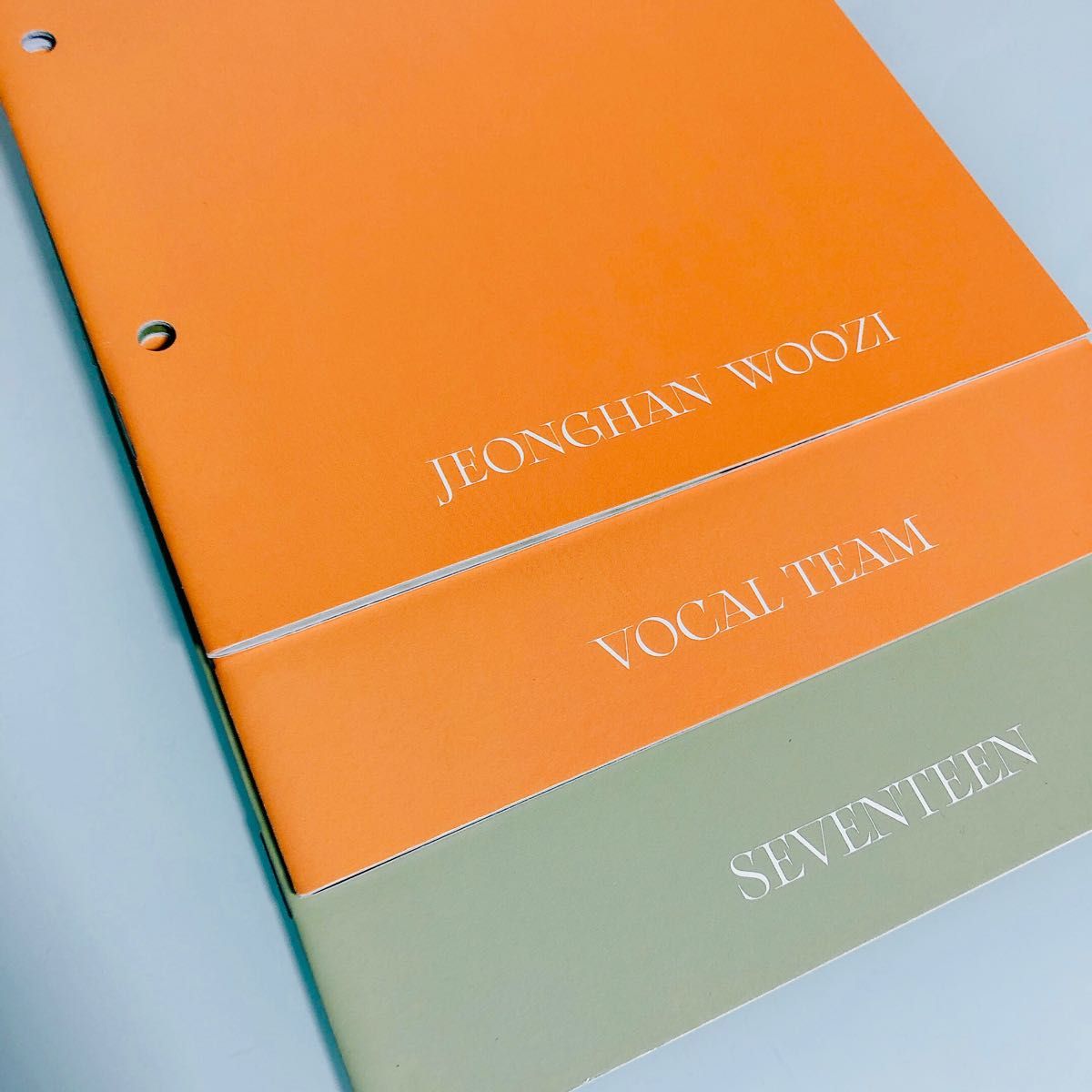

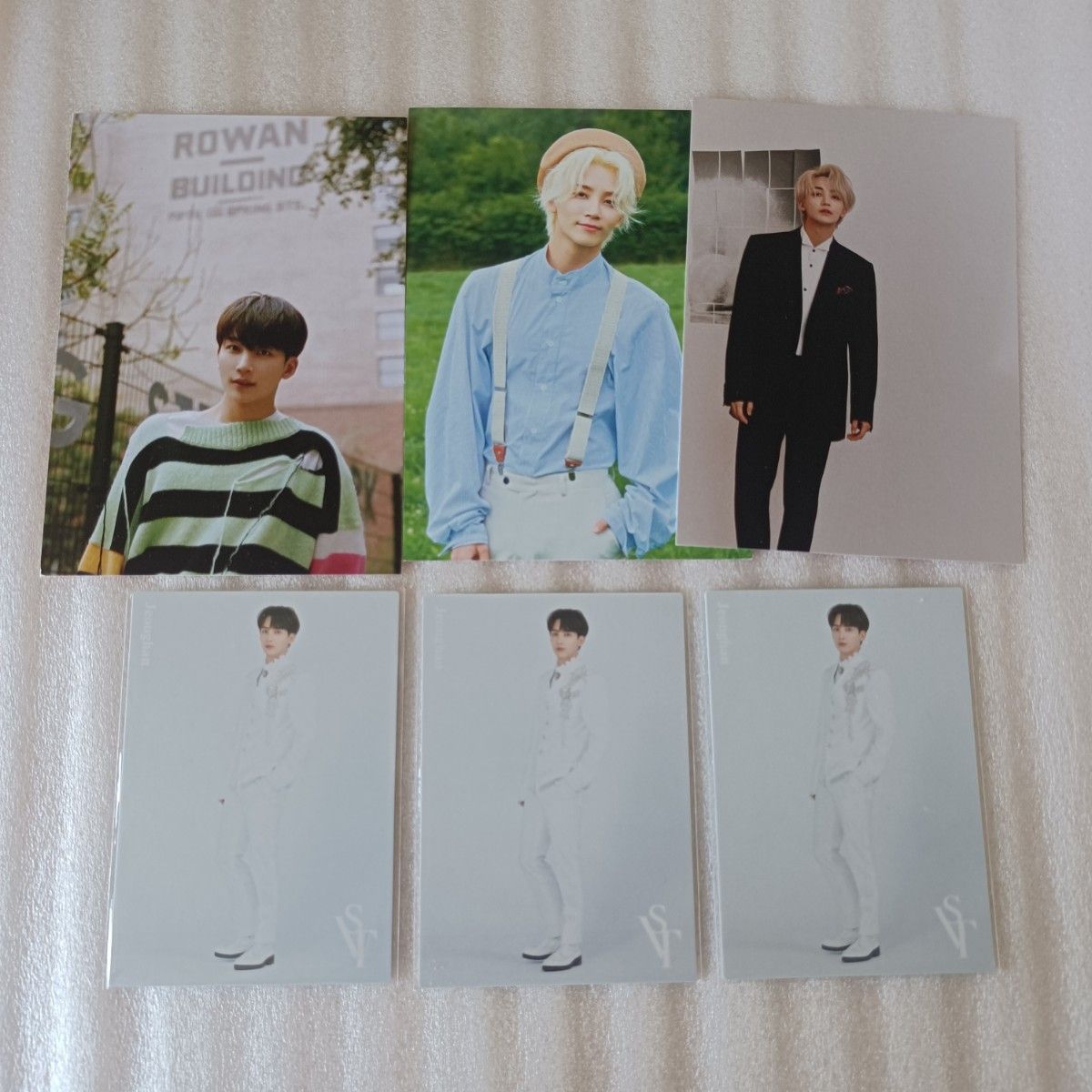

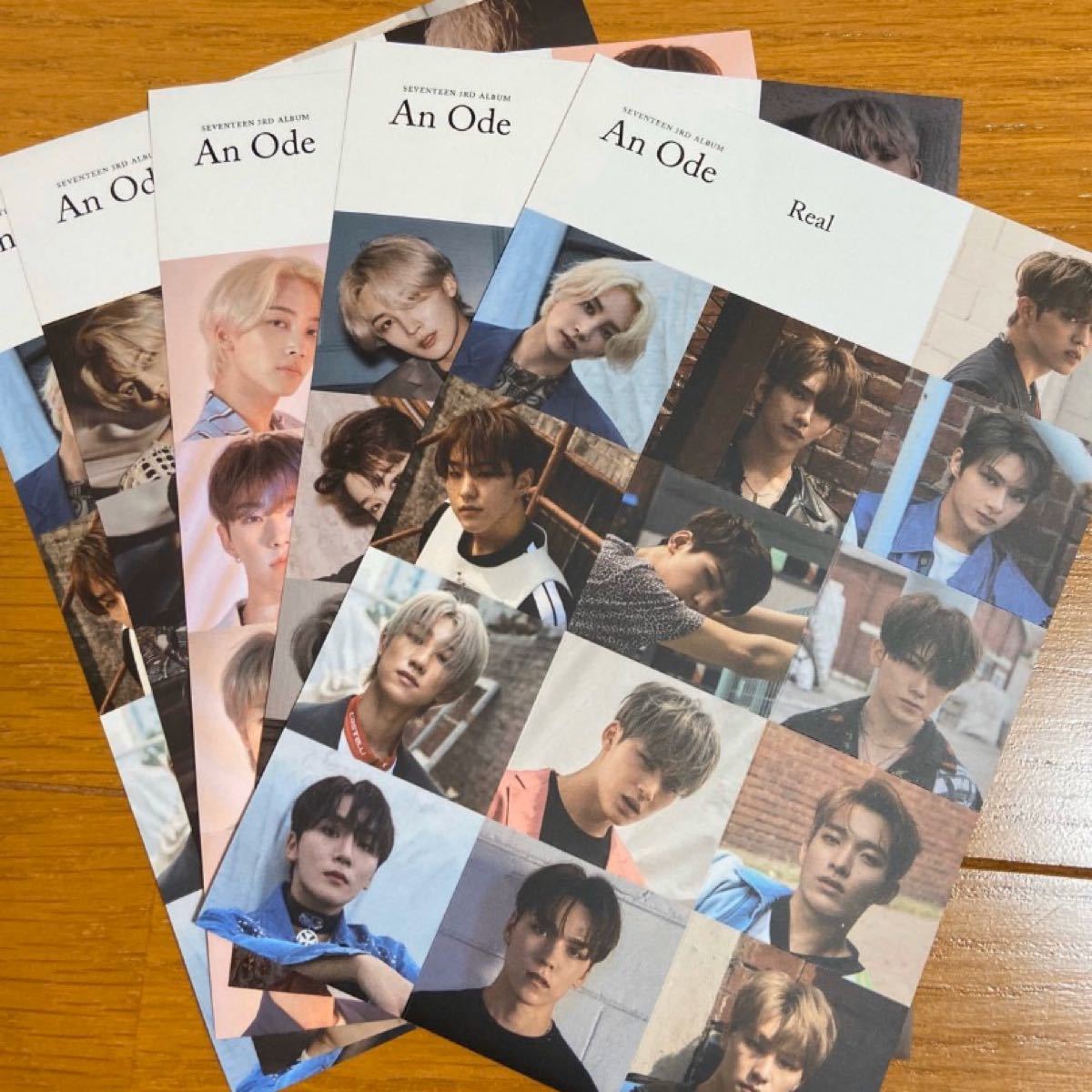

SEVENTEEN ジョンハン ヘンガレ セット

(税込) 送料込み

商品の説明

即購入⭕

バラ売り❌

SEVENTEEN

ジョンハン

ヘンガレ

アルバムトレカ

コンプリートセット コンプ

HMV HMV特典 特典 ステッカー

台湾 ヨントン ヨントントレカ

手元に届きすぐにスリーブに入れて暗所にて保管しております。海外製品にご理解頂ける方のみ購入されて下さい。

厚紙補強+防水梱包にて発送します。

匿名配送ご希望の方は+で変更可能です。商品の情報

| カテゴリー | 本・音楽・ゲーム > CD > K-POP/アジア |

|---|---|

| 商品の状態 | 新品、未使用 |

SEVENTEEN / ジョンハン】ヘンガレ セット 有名ブランド www

SEVENTEEN / ジョンハン】ヘンガレ セット - K-POP/アジア

SEVENTEEN ジョンハン ヘンガレ フォトブックセット | フリマアプリ ラクマ

SEVENTEEN ジョンハン ヘンガレ SET ブックマーク

最上の品質な SEVENTEEN HMV セブチ トレカ- ジョンハン ヘンガレ

大人気新品 SEVENTEEN ジョンハン トレカ ヘンガレ トレカセット K-POP

SEVENTEEN ヘンガレ ジョンハン 期間限定 www.gold-and-wood.com

SEVENTEEN ジョンハン ヘンガレ セット - K-POP/アジア

SEVENTEEN ヘンガレ ブックマーク ジョンハン セット | フリマアプリ ラクマ

SEVENTEEN ジョンハン ヘンガレ ヨントントレカ アイドル | www

SEVENTEEN / ジョンハン】ヘンガレ セット - K-POP/アジア

SEVENTEEN ヘンガレ ジョンハン トレカセット

ペン卒 SEVENTEEN 7TH MINI ALBUM ヘンガレSET ver. ジョンハン ウジ

Amazon.co.jp: SEVENTEEN ジョンハン ヘンガレ SET ver. トレカ 1枚

SEVENTEEN ヘンガレ ブックマーク ジョンハン セット

SEVENTEEN ジョンハン トレカセット-

SEVENTEEN ジョンハン ヘンガレ 4分割 トレカ

ペン卒 SEVENTEEN 7TH MINI ALBUM ヘンガレSET ver. ジョンハン ウジ

SEVENTEEN ジョンハン 公式 うちわ 21点セット トレカ-

SEVENTEEN ヘンガレ HMV 特典 ジョンハン トレカ-

ヘンガレ SET ジョンハン セット

SEVENTEEN ヘンガレ アルバム8枚セット(付属品付き) 最新最全の 9244円

ヘンガレ NET ジョンハン セット

SEVENTEEN ジョンハン ヘンガレ HMVステッカー アイドル | www

ジョンハン トレカ SEVENTEEN セブチ 未使用 ヘンガレ HANA

Amazon.co.jp: SEVENTEEN ヘンガレ ジョンハン トレカセット 4分割

セブチ SEVENTEEN ジョンハン ポストカード フォトカード AnOde ヘンガレ トレカ ドーム

ペン卒 SEVENTEEN 7TH MINI ALBUM ヘンガレSET ver ジョンハン ウジ

ヘンガレ SET ジョンハン セット

SEVENTEEN ジョンハン ヘンガレ シンナラ トレカ ファッション www

SEVENTEEN ジョンハン ヘンガレ NETトレカの通販 by shop|ラクマ

SEVENTEEN - SEVENTEEN ヘンガレ 新品未開封 4形態セットの通販 by

2023年最新】ジョンハン ヘンガレ 4分割の人気アイテム - メルカリ

SEVENTEEN - seventeen ヘンガレ set ブックレット CD セットの通販 by

2023年最新】seventeen ジョンハン ヘンガレの人気アイテム - メルカリ

トレカ&シール5枚セット ジョンハン ヘンガレ ブックマークセット

![新品】SEVENTEEN CD 韓国 7th ALBUM ヘンガレ [Heng:garae] (VER.3 SET](https://img.aucfree.com/v737429994.1.jpg)

新品】SEVENTEEN CD 韓国 7th ALBUM ヘンガレ [Heng:garae] (VER.3 SET

![新品】SEVENTEEN CD 韓国 7th ALBUM ヘンガレ [Heng:garae] (VER.3 SET](https://img.aucfree.com/v737429994.2.jpg)

新品】SEVENTEEN CD 韓国 7th ALBUM ヘンガレ [Heng:garae] (VER.3 SET

SEVENTEEN - ヘンガレ SET ジョンハン セットの通販 by ayk's shop

2023年最新】ジョンハン ヘンガレの人気アイテム - メルカリ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています