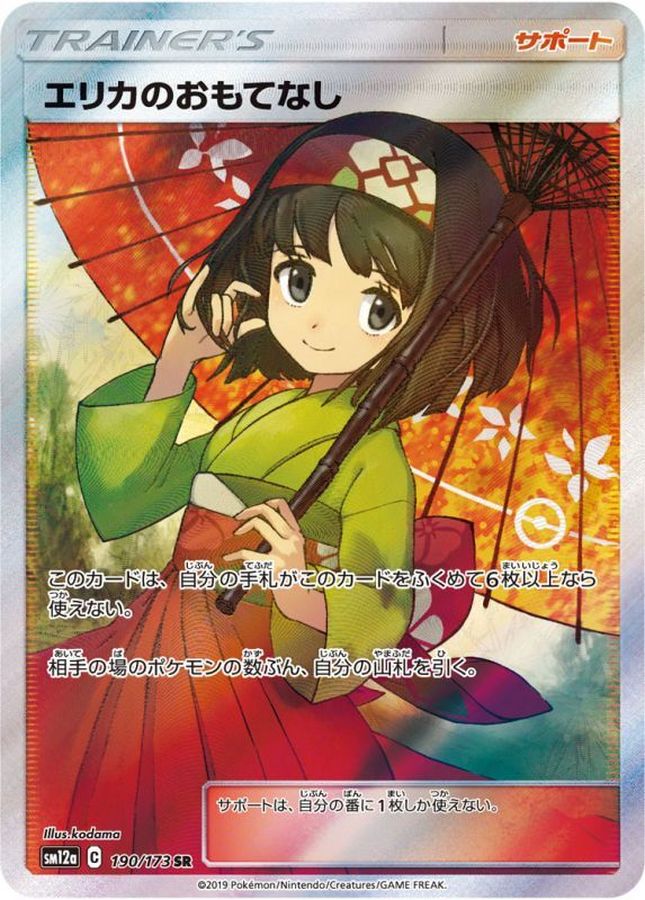

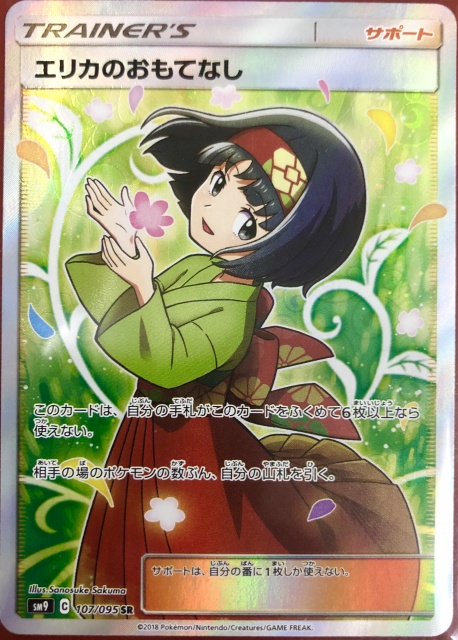

エリカのおもてなし SR

(税込) 送料込み

商品の説明

即購入可能です

神経質な方は購入をお控えください

写真が必要な場合はコメントにお願いします

また商品到着後のすり替え防止の為返品等の対応は致しませんのでご理解いただける方のみ購入をお願いします

写真2枚目カード裏面の右下に白かけがございます

また左下もほんの少しかけております

他の傷は素人目には見つかりませんが完美品ではございませんのでお間違えのないようにお願いします

エリカSR タッグボルト 107/095 SR SM9商品の情報

| カテゴリー | おもちゃ・ホビー・グッズ > トレーディングカード > ポケモンカードゲーム |

|---|---|

| 商品の状態 | やや傷や汚れあり |

ポケモンカード エリカのおもてなし SR - シングルカード

エリカのおもてなし【SR】{107/095}

エリカのおもてなし sr ポケモンカード-

エリカのおもてなし(SR) SM9 107/95-

エリカのおもてなし sr-

ポケモン - エリカのおもてなし SRの+spbgp44.ru

ポケモンカード エリカのおもてなし SR-

エリカのおもてなし SR PSA10-

エリカのおもてなし SR-

激安超安値 ポケモン - エリカのおもてなし sr シングルカード

ポケカ エリカのおもてなし SR-

ポケモンカード エリカのおもてなし SRの+aei.art.br

エリカのおもてなし(107/095 SR) | SR | ドラゴンスター | ポケモンカード

ポケモンカードゲーム SM9 拡張パック タッグボルト エリカのおもてなし SR | ポケカ サポート トレーナーズカード

ポケモンカ ポケモンカード エリカのおもてなし SR 31rwN-m86497283523

2023年最新】エリカのおもてなし srの人気アイテム - メルカリ

ポケカ エリカのおもてなし SR-

PSA10】エリカのおもてなし SR 107/095の通販 magi公式ショップ(委託

ポケカ】エリカのおもてなし 買取価格を10社徹底比較| ヒカカク!

ポケカ】エリカのおもてなしSRの最新相場や値段の推移|タッグ

ポケモンカード エリカのおもてなしsr-

PSA10】エリカのおもてなし (SR) 190/173 SM12a | カードン秋葉原本店

エリカのおもてなし SR-

ポケモン - エリカのおもてなし SRの+spbgp44.ru

エリカのおもてなし SR+forest-century.com.tw

ポケモンカード エリカのおもてなし sr-

エリカのおもてなしSRの通販 トモ(403515090) | magi

エリカのおもてなし SR-

エリカのおもてなし SR 190/173 直売取扱店 シングルカード serendib.aero

エリカのおもてなし SR-

エリカのおもてなしsr-

毎日更新】エリカのおもてなし SRの高騰予想/買取価格/価格推移/PSA10

エリカのおもてなし sr 極美品 無料発送 51.0%OFF www.coopetarrazu.com

状態C〕エリカのおもてなし【SR】{107/095}

2023年最新】エリカのおもてなし srの人気アイテム - メルカリ

毎日更新】《エリカのおもてなし》SRの最新買取値段まとめ【全7店舗比較】

エリカのおもてなし SR-

ポケカ】エリカのおもてなしSRの最新相場や値段の推移|タッグ

エリカのおもてなし sr-

エリカのおもてなし SR-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています