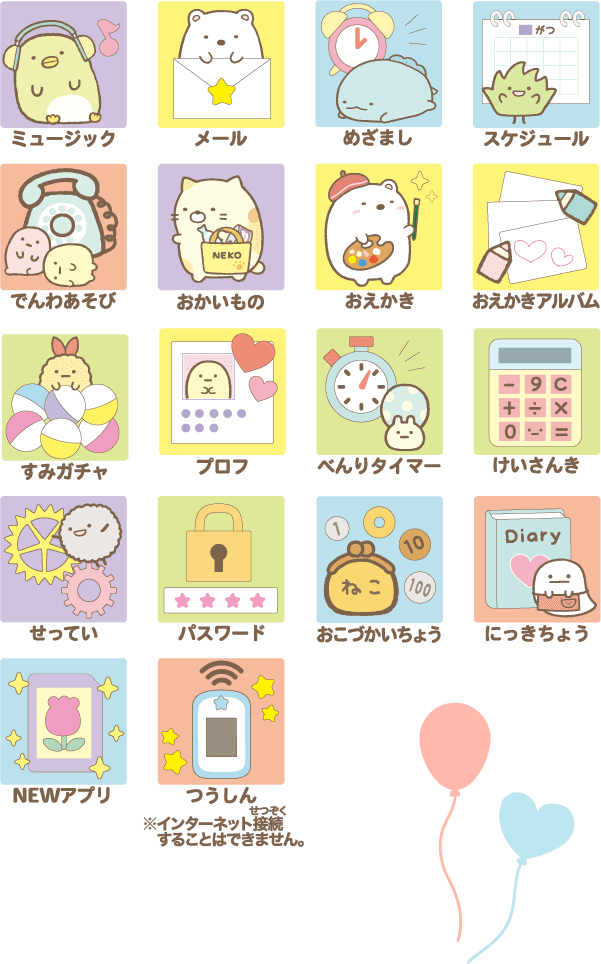

すみっこぐらしPHONE

(税込) 送料込み

商品の説明

新品未使用、未開封品です。

よろしくお願いします!商品の情報

| カテゴリー | おもちゃ・ホビー・グッズ > おもちゃ > キャラクターグッズ |

|---|---|

| 商品の状態 | 新品、未使用 |

Amazon.co.jp: セガトイズ(SEGA TOYS) カードできせかえ! すみっコ

限定特典付き】カードできせかえ!すみっコぐらしPhone|セガトイズ.com

セガトイズ カードできせかえ!すみっコぐらしPhone (電子玩具) 価格

カードできせかえ!すみっコぐらしPhone with U|セガトイズ

カードできせかえ!すみっコぐらしphone with U セガトイズ|SEGATOYS

楽天市場】【販売終了】カードできせかえ!すみっコぐらしPhone

カードできせかえ!すみっコぐらしPhone with U|セガトイズ.com

カードできせかえ!すみっコぐらしPhone 〔即出荷〕SEGA TOYS / セガトイズ : 146-811456 : 変テコ雑貨のにぎわい商店 - 通販 - Yahoo!ショッピング

スマホトイの最新作「カードできせかえ!すみっコぐらしPhone with U

令和時代の大ヒットシリーズにスマホ型玩具が登場!「カードできせかえ

カードできせかえ!すみっコぐらしPhone with U|セガトイズ

令和時代の大ヒットシリーズにスマホ型玩具が登場!『カードできせかえ

楽天市場】カードできせかえ!すみっコぐらしPhone(1個)【セガトイズ

カードできせかえ!すみっコぐらしPhone with U|セガトイズ

Amazon | すみっこぐらし カードできせかえ! Phone NNBBZ7W0 | アニメ

カードできせかえ!すみっコぐらしPhone | 玩具の卸売サイト カワダ

セガトイズ カードできせかえ!すみっコぐらしPhone | ヤマダウェブコム

セガ公式アカウント🦔 on X:

カードできせかえ! すみっコぐらしPhone 【すみっコぐらしパソコン

すみっコぐらし カードできせかえ!すみっコぐらしPhone with U お一人

Instagram投稿募集】カードできせかえ!すみっコぐらしPhone

令和時代の大ヒットシリーズにスマホ型玩具が登場!『カードできせかえ

セガトイズ、各世代で大流行のトレンドを反映したスマホトイ最新商品

すみっコぐらし - カードできせかえ!すみっコぐらしphone まつごろう

カードできせかえ!すみっコぐらしPhone』いよいよ発売|セガ SEGA

とれたて最新情報-What's New-

カードできせかえ!すみっコぐらしPhone with U|セガトイズ

カードできせかえ!すみっコぐらしPhone 〔即出荷〕SEGA TOYS / セガトイズ

楽天市場】【販売終了】カードできせかえ!すみっコぐらしPhone

カードできせかえ!すみっコぐらしPhone | 玩具の卸売サイト カワダ

セガトイズ カードできせかえ!すみっコぐらしPhone (電子玩具) 価格

Amazon.co.jp: セガトイズ(SEGA TOYS) カードできせかえ!すみっコ

セガトイズ カードできせかえ!すみっコぐらしPhone | ヤマダウェブコム

すみっコぐらし』トレンドを反映したスマホの最新商品がセガトイズより

令和時代の大ヒットシリーズにスマホ型玩具が登場!『カードできせかえ

カードできせかえ!すみっコぐらしPHONE

カードできせかえ! すみっコぐらしPhone 【すみっコぐらしパソコンプレミアムシリーズと連動】|au PAY マーケット

セガトイズ カードできせかえ!すみっコぐらしPhone の通販 | カテゴリ

Amazon.co.jp: セガトイズ(SEGA TOYS) カードできせかえ! すみっコ

高品質安い サンエックス - すみっコぐらし カードできせかえ すみっコ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています