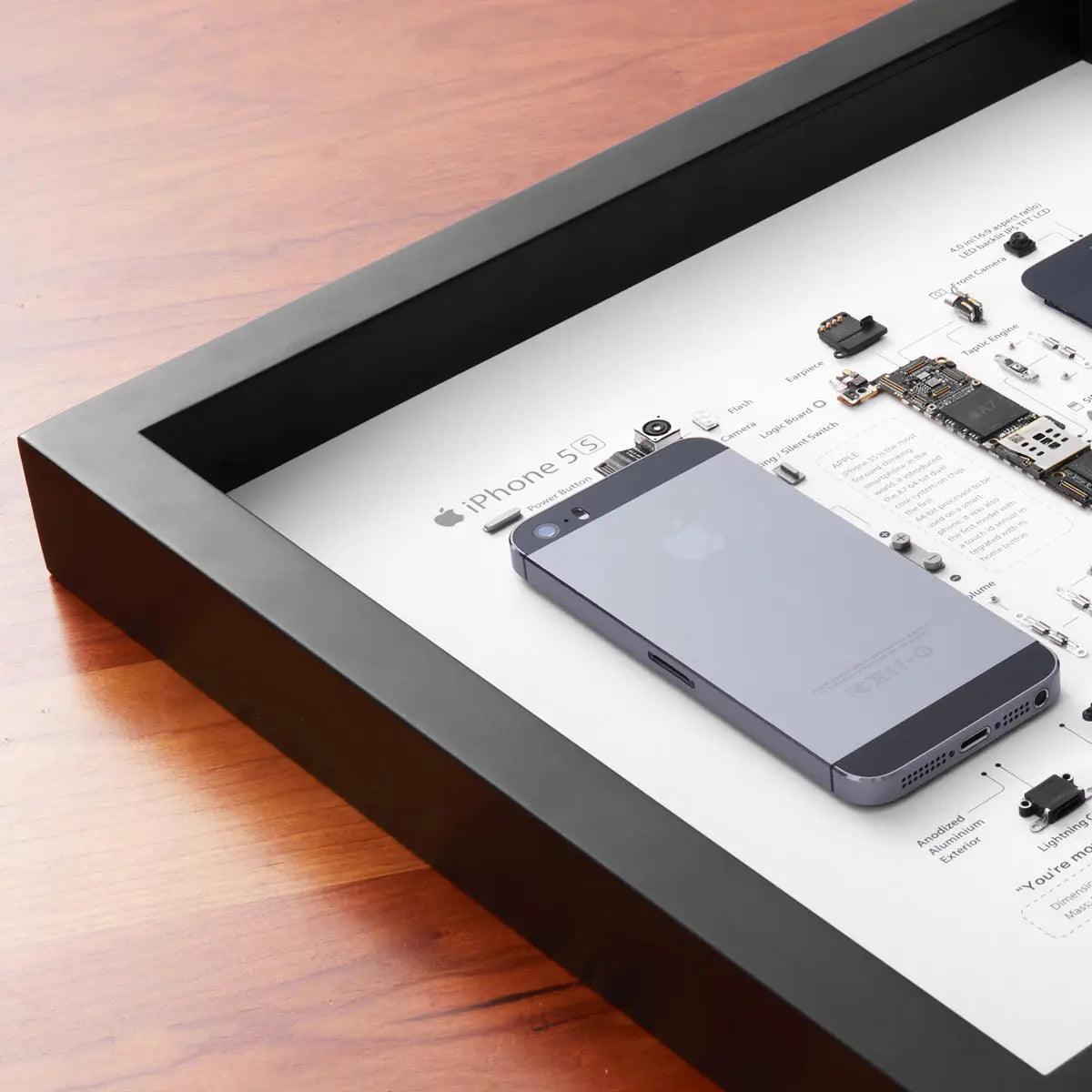

iPhone 5 インテリアフレーム

(税込) 送料込み

商品の説明

カラー···ブラック系

タイプ···ウォールフレーム商品の情報

| カテゴリー | インテリア・住まい・小物 > インテリア小物 > フォトフレーム |

|---|---|

| 商品の状態 | 新品、未使用 |

XreArt 5 Frame

XreArt 5 Frame

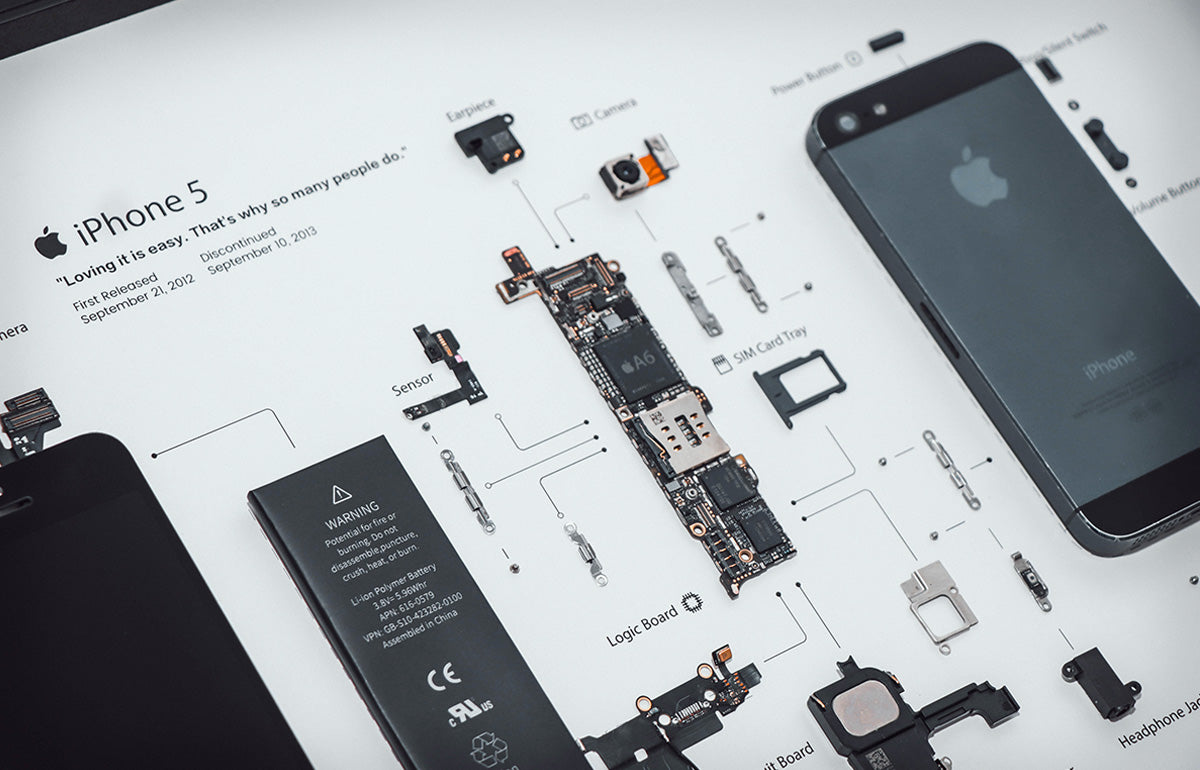

Xreart iPhone 5 3D Framed Handmade Artwork Wall Decor

Xreart iPhone 5 3D Framed Handmade Artwork Wall Decor

Framed iPhone 5 Disassembled Phone Teardown iPhone Wall Art Gifts for Tech / Apple Lovers A3 Frame - Etsy 日本

iPhone 5 インテリアフレーム-

| Grid Studio iPhone 5 Wall Art Decor Frame | A Great Collectors Item Or Gift For An Apple Fan |

iPhone 5 インテリアフレーム-

日本初上陸】iPhone分解アート作品を手掛ける「GRID STUDIO」が日本初

iPhone 4 標本アート 自作 ボックスフレーム仕様(A3)

Xreart iPhone 5 3D Framed Handmade Artwork Wall Decor

楽天市場】iPhoneケース メタルフレーム クリア iPhone14 iPhone14Pro

メタルフレームiPhoneケース【iPhone12・iPhone13・iPhone13mini

シンプル カラー ウェーブ なみなみ フレーム iPhoneケース (ピンク/ブルー/ホワイト/ブラック/パープル/イエロー) | Coco Rose Beauty (ココ ローズ ビューティー) powered by BASE

モバイルケース メッキゴールドフレーム iphoneケース スマホケース

メタルフレームiPhoneケース【iPhone12・iPhone13・iPhone13mini

Apple iPhone 5S Teardown/framed/disassembled Cell Phone Component

モバイルケース メッキゴールドフレーム iphoneケース スマホケース

2023年版】デジタルフォトフレームのおすすめ15選。プレゼントや

キャンディー シンプルカラー 丸型 カメラフレーム iPhoneケース (ピンク/ブルー/ホワイト/ブラック/パープル/イエロー) | Coco Rose Beauty (ココ ローズ ビューティー) powered by BASE

メタルフレームiPhoneケース【iPhone12・iPhone13・iPhone13mini

日本初上陸】iPhone分解アート作品を手掛ける「GRID STUDIO」が日本初

Framed iPhone 5 Disassembled Phone Teardown iPhone Wall Art Gifts

GRID STUDIO Apple iPhone5S 分解アート-

モバイルケース メッキゴールドフレーム iphoneケース スマホケース

日本初上陸】iPhone分解アート作品を手掛ける「GRID STUDIO」が日本初

2023年】iPhone 5sケースのおすすめ人気ランキング40選 | mybest

シンプル カラー ウェーブ なみなみ フレーム iPhoneケース (ピンク/ブルー/ホワイト/ブラック/パープル/イエロー) | Coco Rose Beauty (ココ ローズ ビューティー) powered by BASE

Grid Studio GRID® 5 レビュー】古いiPhoneを分解してフレームに美しく

楽天市場】iPhoneケース メタルフレーム クリア iPhone14 iPhone14Pro

iPhoneケース スマホケース メッキフレーム[品番:MG000007911

メタルフレームiPhoneケース【iPhone12・iPhone13・iPhone13mini

IPhone 5C Teardown Template, iPhone Teardown, Framed Iphone

モバイルケース メッキゴールドフレーム iphoneケース スマホケース

シンプル カラー ウェーブ なみなみ フレーム iPhoneケース (ピンク

iPhoneケース スマホケース メッキフレーム[品番:MG000007911

USB-C搭載“iPhone 15”シリーズ発表、”Pro Max””はチタニウムに光学5倍

iPhone5 標本アート 自作 フレーム(A3) - アート/写真

Amazon.co.jp: サイバーパンク スタジオジブリ アニメ ポスター 5

メタルフレームiPhoneケース【iPhone12・iPhone13・iPhone13mini

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています