フナイ 32インチテレビ FL-32H1010

(税込) 送料込み

商品の説明

即購入可能です!!

フナイ 32V型 地上・BS・110度CSデジタル

2019年製

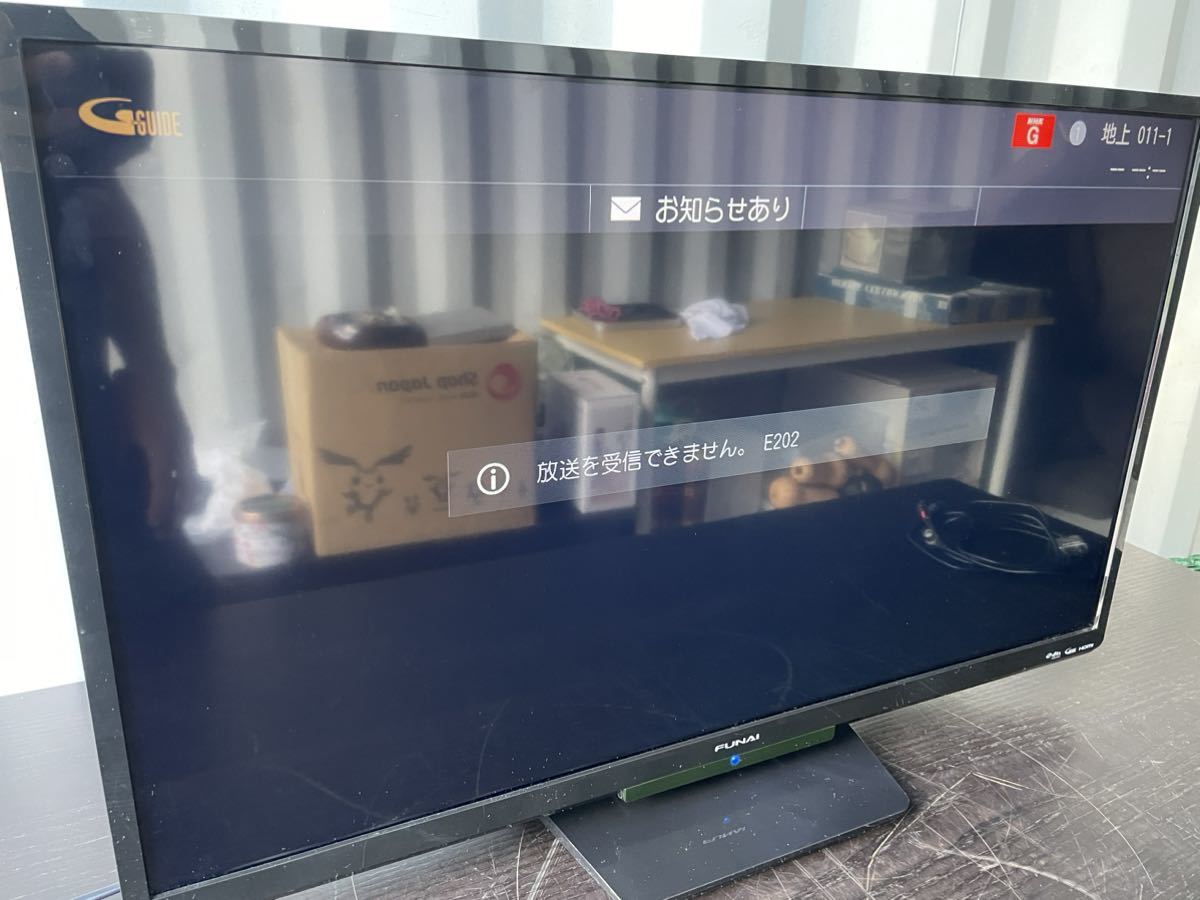

3年ほど前に新品で購入し、動作は特に問題ございません。使用頻度も低く、大きな傷は見当たらない状態です。

接続に必要な電源ケーブルと、同軸ケーブルは付属しておりますが、リモコンは付属しておりませんのでご留意ください。

※純正リモコンはAmazon

(参考)Amazon新品価格

以下仕様です。

−−−−−−−−−−

説明

フナイ FL-32H1010 FUNAI FL-32H1010 32V型 地上・BS・110度CSデジタル ハイビジョン液晶テレビ 発売日:2018年7月14日

●料理番組のレシピなどが確認しやすい「静止画機能」 必要なシーンでテレビ映像を静止できます。キャンペーンの応募先を書き留める際にも便利です。 ●番組の音量変化を自動的に調整する「ぴったり音量」 CMや番組の切り換わりなど、音量が大きく変わる時に、音量の変化を自動的に調整し、聞きやすくします。

●他の機器も操作できるファンリンク (HDMI-CEC) HDMI-CEC対応の機器と接続すれば、テレビのリモコンで他の機器も操作できます。

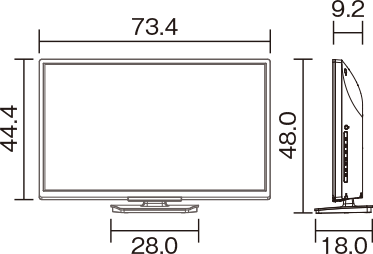

【仕様】 画面サイズ 32インチ ハイビジョン対応 ハイビジョン 年間消費電力量 54kWh/年 消費電力 45W 消費電力 (待機時) 0.1W 音声実用最大出力 (総合) 16W BSデジタルチューナー数 2 110°CSデジタルチューナー数 2 LAN端子数 1 USB端子数 1 地上デジタルチューナー数 2 HDMI端子数 3 ARC対応 有 画素数 (水平×垂直) (水平)1366 × (垂直)768 画面サイズ(幅×高さ/対角) (幅) 69.8cm×(高さ) 39.2cm/ (対角) 80.0cm 質量 6.0kg (スタンドなし: 5.8kg) 液晶倍速表示 通常(60Hz) ビデオ入力端子数 1 外付HDD対応 可 外付けHDD録画方式 裏番組録画 USBハードディスク同時接続商品の情報

| カテゴリー | 家電・スマホ・カメラ > テレビ/映像機器 > テレビ |

|---|---|

| 商品のサイズ | 26~32インチ |

| 商品の状態 | 目立った傷や汚れなし |

フナイ 32V型 液晶テレビ ハイビジョン ダブルチューナー 外付けHDD対応(裏番組録画可能) FL-32H1010 地上・BS・110度CSデジタル

フナイ 32V型 液晶テレビ ハイビジョン ダブルチューナー 外付けHDD対応(裏番組録画可能) FL-32H1010 地上・BS・110度CSデジタル

1010シリーズ|テレビ|FUNAI製品情報

セール国産 FUNAI 32V型 液晶テレビ FL-32H1010 vWHNu-m78976183603

![薄型テレビ・液晶テレビ FL-32H1010 [32インチ]](https://cdn2.2ndstreet.jp/img/sp/goods/233331/04/68320/1_mn.jpg)

薄型テレビ・液晶テレビ FL-32H1010 [32インチ]

FUNAI - FUNAI 32インチ 液晶テレビ FL-32H1010の通販 by よし's shop

![フナイ FL-32H1010 [32インチ] 価格比較 - 価格.com](https://img1.kakaku.k-img.com/images/smartphone/icv/l_K0001070939.jpg)

フナイ FL-32H1010 [32インチ] 価格比較 - 価格.com

FUNAI(フナイ) / 薄型テレビ・液晶テレビ FL-32H1010 [32インチ

セール爆買い フナイ 32V型 液晶テレビ FL-32H1010 裏番組録画対応

![FUNAI(フナイ) / 薄型テレビ FL-32H1010 [32インチ] | 中古品の販売](https://cdn2.2ndstreet.jp/img/sp/goods/234055/00/48922/2_mn.jpg)

FUNAI(フナイ) / 薄型テレビ FL-32H1010 [32インチ] | 中古品の販売

![薄型テレビ・液晶テレビ FL-32H1010 [32インチ]](https://cdn2.2ndstreet.jp/img/sp/goods/233331/04/68320/2_mn.jpg)

薄型テレビ・液晶テレビ FL-32H1010 [32インチ]

FUNAI - FUNAI 32インチ 液晶テレビ FL-32H1010の通販 by よし's shop

![FUNAI(フナイ) / 薄型テレビ FL-32H1010 [32インチ] | 中古品の販売](https://cdn2.2ndstreet.jp/img/sp/goods/233008/04/04053/1_mn.jpg)

FUNAI(フナイ) / 薄型テレビ FL-32H1010 [32インチ] | 中古品の販売

H31/03月22日【フナイ FL-32H1010 32V型ハイビジョン液晶テレビ [32

FUNAI(フナイ) / 薄型テレビ・液晶テレビ FL-32H1010 [32インチ

![FUNAI(フナイ) / 薄型テレビ FL-32H1010 [32インチ] | 中古品の販売](https://cdn2.2ndstreet.jp/img/sp/goods/233008/04/04053/2_mn.jpg)

FUNAI(フナイ) / 薄型テレビ FL-32H1010 [32インチ] | 中古品の販売

12. FUNAI 32インチ 液晶カラーテレビ FL-32H1010 大阪 セール テレビ

FUNAI製リユーステレビ 新入荷!! – 再楽ドットネット

FUNAI/フナイ◇32型 液晶テレビ 18年製◇FL-32H1010 商品细节 | 雅虎

![FUNAI(フナイ) / 薄型テレビ FL-32H1010 [32インチ] | 中古品の販売](https://cdn2.2ndstreet.jp/img/sp/goods/233008/04/04053/8_mn.jpg)

FUNAI(フナイ) / 薄型テレビ FL-32H1010 [32インチ] | 中古品の販売

セール爆買い フナイ 32V型 液晶テレビ FL-32H1010 裏番組録画対応

Amazon | フナイ 32V型 液晶テレビ ハイビジョン ダブルチューナー 外

FUNAI(フナイ) / 薄型テレビ・液晶テレビ FL-32H1010 [32インチ

12. FUNAI 32インチ 液晶カラーテレビ FL-32H1010 大阪 セール テレビ

♪FUNAI/フナイ FL-32H1010 2021年 32型TV 液晶テレビ♪ - テレビ

1010シリーズ|テレビ|FUNAI製品情報

FUNAI(フナイ) / 薄型テレビ・液晶テレビ FL-32H1010 [32インチ

セール爆買い フナイ 32V型 液晶テレビ FL-32H1010 裏番組録画対応

ACm009R FUNAI フナイ 32インチ 液晶テレビ FL-32H1010 リモコン FRM

218*中古品 高年式 2020年製 FUNAI フナイ 32インチ 液晶カラーテレビ

FUNAI(フナイ) / 薄型テレビ・液晶テレビ FL-32H1010 [32インチ

FUNAI 32インチ 液晶カラーテレビ リモコン付き-

FUNAI(フナイ) / 薄型テレビ・液晶テレビ FL-32H1010 [32インチ

FUNAI フナイ 32インチ 液晶テレビ FL-32H1010 リモコン付き - テレビ

リユース品 フナイ32型テレビ FL-32H1010 2021年製 - テレビ

FUNAI 32インチ 液晶カラーテレビ リモコン付き-

32インチ液晶テレビ】FUNAI FL-32H1010+firetvstick 激安大特価

FUNAI(フナイ) / 薄型テレビ・液晶テレビ FL-32H1010 [32インチ

FUNAI フナイ 32V型 液晶テレビ FL-32H1010 32インチTV 2019年製の落札

FUNAI 32V型 液晶テレビ FL-32H1010 安いオンライン テレビ serendib.aero

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています