【高機能 HDDレコーダー録画内蔵】37型 液晶テレビ 東芝 REGZA レグザ

(税込) 送料込み

商品の説明

⭕⭕️40型に迫る37V型!

レコーダー一体型の快適モデル。多彩な楽しい録画機能、ネット機能と満足度の高いTVです。滑らか倍速液晶に人気のツヤありフレーム!

◎別売OP品付、多数付属品!

⭐️⭐️テレビに大容量500ギガHDD内蔵で即録画!更に外付けHDDの追加可で将来性も◎

⭐️ボタン1つの簡単録画!

⭐️Wチューナー(2チューナー)で録画中でも他の番組視聴可!

⭐️見ていて気に入った番組を「連ドラ予約」で次回からその番組を自動的に録画予約

⭐️今すぐニュース機能で、いつでもニュースを視聴!→スマホをいじりながら空き時間等に便利!

⭐️Dボタンから様々なコンテンツにアクセス!

→ゲーム、クイズ、占いなどを無料で楽しめます!ネット環境無しで楽しめます。

⭐️「ゲームダイレクト」搭載で遅延信号減

→PS4.5等の次世代ゲーム、格闘、FPS等に!

⭕基本機能も、PS4,5や、任天堂スイッチ、MacBookを繋いだり、自動明るさセンサー、自動オフ、オフ、オンタイマー(目覚ましに!)、省エネ機能

…等その他多数

✅1,5倍速早見再生もあるので、ニュースや話題のドラマチェック等、時短派にぴったり!

⭕上位機種ならではの、

HDMIx4、LAN、USB、D端子、光端子、s端子、音声、イヤホン端子、赤白黄x4、の充実装備

<<状態>>

○安心の動作確認済。良好ですが多少埃すれ汚れ等ご了承ください。本体振ると小物混入がわかりますが使用問題無し。装着可能物装着発送。

TOSHIBA REGZA 37V型 地上、BS、CS。パネル性能···FullHD(フルハイビジョン)2011年 ブラック 黒 各種ケーブル別売。スカパー、WOWOW視聴可

《内容》すぐ使用出来る内容

テレビ

電源コード(装着済)

アンテナケーブル

リモコン

B-CASカード

電池カバー

電池x2

転倒防止バー、ネジ

取扱説明書x3

◎スマホ等から登録無しですぐ取説が見れる機種

#フリマのTV屋さん

※出品者の方へ

説明文、画像(画像中の文面含む)、タイトル等の、流用、コピーは公式の規約違反です。コメント欄に警告文記載後、証拠写真撮影の上、然るべきアカウントの処分を求め、運営様に即通報させていただきます(一部、全部、同じ内容全て)

種類···液晶テレビ商品の情報

| カテゴリー | 家電・スマホ・カメラ > テレビ/映像機器 > テレビ |

|---|---|

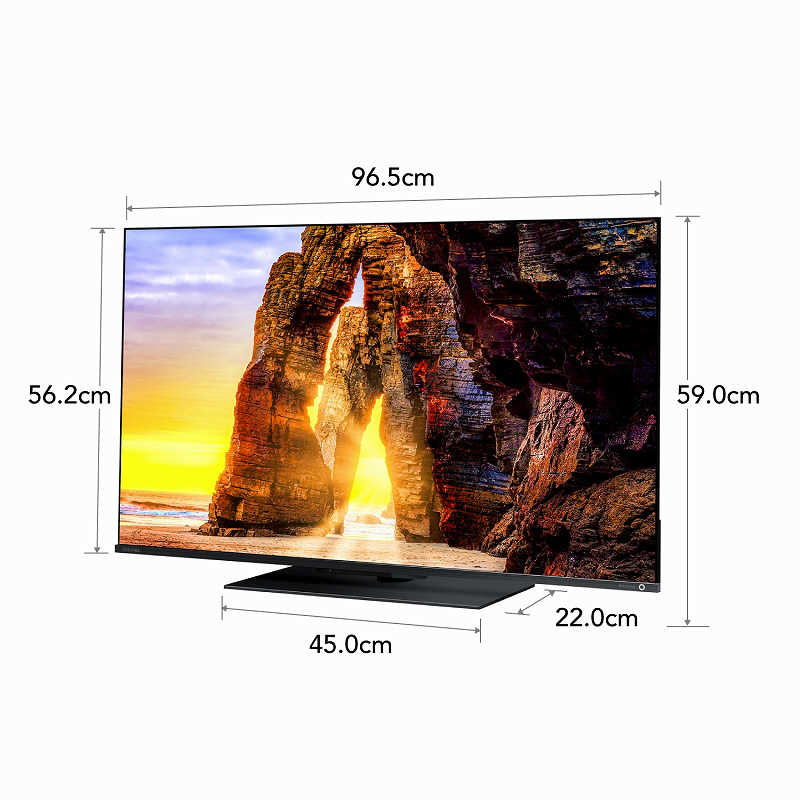

| 商品のサイズ | 37~40インチ |

| ブランド | 東芝 |

| 商品の状態 | 目立った傷や汚れなし |

高機能 HDDレコーダー録画内蔵】37型 液晶テレビ 東芝 REGZA レグザ

高機能 HDDレコーダー録画内蔵】37型 液晶テレビ 東芝 REGZA レグザ

公式ショップ】 ☆東芝 TOSHIBA 37V型液晶テレビ◇外付け

高機能 HDDレコーダー録画内蔵】37型 液晶テレビ 東芝 REGZA レグザ

美品 TOSHIBA REGZA 32型 録画機能付き HDD内蔵 液晶テレビ

東芝37V型液晶テレビ - テレビ

TOSHIBA液晶テレビ 内蔵HDDで録画可能 37V型 Yahoo!フリマ(旧)-

東芝、録画対応「LED REGZA HE1」に42V/37V型追加 - 価格.com

TOSHIBA液晶テレビ 内蔵HDDで録画可能 37V型 Yahoo!フリマ(旧)-

標準設置無料 設置Aエリアのみ) 東芝 75型4Kチューナー内蔵 LED液晶

H1・H1S/TOP|テレビ|REGZA:東芝

東芝 32型 ハイビジョンLED液晶テレビ (別売USB HDD録画対応

Amazon | 東芝 50V型 液晶テレビ レグザ 50M530X 4Kチューナー内蔵 外

REGZA 43C350X 4K液晶テレビ REGZA(レグザ)【43V型/4Kチューナー内蔵

標準設置無料 設置Aエリアのみ) 東芝 55型4Kチューナー内蔵 LED液晶

Amazon.co.jp: REGZA 24V型 液晶テレビ レグザ 24V34 ハイビジョン 外

液晶テレビ REGZA(レグザ) 43C340X [43V型 /4K対応 /BS・CS 4K

43型地上・BS・110度CSデジタル4Kチューナー内蔵 LED液晶テレビ

小型でも高機能で快適な東芝の「ミニREGZA」|『家電批評』が検証

ニュースリリース (2008.9.18-5) | ニュース | 東芝

新製品レビュー】

楽天市場】東芝 TOSHIBA REGZA (レグザ) 液晶テレビ 50V型 4K

東芝 REGZA 液晶テレビ レグザ 43M540X [43V型/外付けHDD/4Kチューナー

RE1・RE1S/TOP|テレビ|REGZA:東芝

Amazon | 東芝 50V型 液晶テレビ レグザ 50M530X 4Kチューナー内蔵 外

21機種が録画対応に,東芝が液晶テレビ「REGZA」を発表 | 日経クロス

東芝(TOSHIBA) 40V型 液晶テレビ REGZA(レグザ)|40V34|[通販

東芝、世界初の超解像技術搭載モデルなど液晶テレビ「REGZA」新

標準設置無料 設置Aエリアのみ) 東芝 65型4Kチューナー内蔵 LED液晶

東芝レグザREGZAの値段と価格推移は?|10件の売買データから東芝

6TB HDD/8チューナー搭載 ブルーレイレコーダー4Kチューナー内蔵

HB2/TOP|テレビ|REGZA:東芝

東芝、倍速/USB HDD録画対応のフルHD液晶テレビ

デンキチ公式通販サイト-埼玉県下ナンバーワン家電量販店 / 東芝

2023年版】ブルーレイレコーダーのおすすめ18選|選び方も解説 | 家電

![ヨドバシ.com - 東芝 TOSHIBA 32H9000 [REGZA(レグザ) 32H9000] 通販](https://image.yodobashi.com/product/100/000/001/001/163/272/100000001001163272_10203.jpg)

ヨドバシ.com - 東芝 TOSHIBA 32H9000 [REGZA(レグザ) 32H9000] 通販

東芝、LEDバックライトやW録画などレグザのラインナップを一新 | マイ

デンキチ公式通販サイト-埼玉県下ナンバーワン家電量販店 / 東芝

楽天市場】東芝 TOSHIBA REGZA(レグザ) 液晶テレビ 43V型 4Kチューナー

21機種が録画対応に,東芝が液晶テレビ「REGZA」を発表 | 日経クロス

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています