水素水生成器 AQUANODE 未使用

(税込) 送料込み

商品の説明

新品未使用品

アクセサリーキッド付

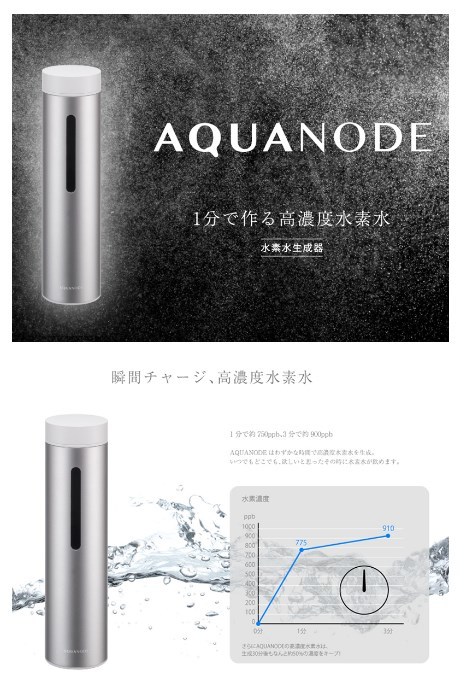

タンク容量 約120ml (作り立て飲み切りサイズです。)商品の情報

| カテゴリー | コスメ・香水・美容 > その他 > 健康用品 |

|---|---|

| 商品の状態 | 新品、未使用 |

AQUANODE 水素水生成器-單入組(公司貨) | 個人/車用| Yahoo奇摩購物中心

水素水生成機 AQUANODE(アクアノード)プレミアムキット - その他

1589 AQUANODE 水素水生成器 HB-V01+ACC-BR ブラウン 未使用-

博客來-【cado】AQUANODE水素水生成器-單入組(公司貨)褐色

AQUANODE 水素水生成器單入組高濃度水素水3分鐘瞬間生成高科技微米氣泡

博客來-【cado】AQUANODE水素水生成器-單入組(公司貨)褐色

最旬トレンドパンツ カドー 水素水生成器 AQUANODE アクセサリーキット

1589 AQUANODE 水素水生成器 HB-V01+ACC-BR ブラウン 未使用-

人気ショップ (カドー) シルバー 水素水ハンディボトル (AQUANODE

未使用】AQUANODE アクアノード 水素水生成器 水素水 HB-V01 | www

中古】 AQUANODE 水素水生成器 プレミアムキット HB-V01+ACC シルバー

未使用】AQUANODE アクアノード 水素水生成器 水素水 HB-V01 | www

人気の雑貨がズラリ! アクアノード 【未使用】AQUANODE 水素水生成器

AQUANODE 高濃度水素水生成器 - ボディケア/エステ

1589 AQUANODE 水素水生成器 HB-V01+ACC-BR ブラウン 未使用-

.jpg)

AQUANODE 水素水生成器+噴吸兩用組首創一瓶三用~飲用、吸入、噴霧按壓

2023年最新】AQUANODEアクアノードの人気アイテム - メルカリ

CADO AQUANODE 水素水生成器 單入組 台灣公司貨 蝦幣10倍送

新品・未使用・未開封】cado AQUA NODO 高濃度水素水生成器 1 正規

高濃度水素水生成器 ルルドの+cidadesinvisiveis.com.br

AQUANODE 水素水生成器+噴吸兩用組首創一瓶三用,

♪新品♪ cado 水素水生成器 AQUANODE アクアノード HB-V01 - その他

オンライン人気商品 【未使用/通電OK】フラックス 水素ウォーター

博客來-【cado】AQUANODE水素水生成器-單入組(公司貨)銀色

1589 AQUANODE 水素水生成器 HB-V01+ACC-BR ブラウン 未使用-

新品 未使用】AQUANODEプレミアムキット 水素水生成器 ブラウンの通販

日本aquanode水素水杯-便携式水素水生成器_手机搜狐网

水素王国|水素水生成器 AQUANODE(アクアノード)

独特な 【送料無料】 店長特選☆水素水生成器 超高濃度 携帯用 健康

2023年最新】AQUANODEアクアノードの人気アイテム - メルカリ

日本aquanode水素水杯-便携式水素水生成器_手机搜狐网

カドー 水素水生成器 アクアノード プレミアムキットモデル シルバー

.jpg)

AQUANODE 水素水生成器+噴吸兩用組首創一瓶三用~飲用、吸入、噴霧按壓

未使用】AQUANODE アクアノード 水素水生成器 水素水 HB-V01 | www

Amazon | (カドー) cado 水素水生成器 (AQUANODE)アクアノード 水素水

未使用】AQUANODE アクアノード 水素水生成器 水素水 HB-V01 www

中古】 AQUANODE 水素水生成器 プレミアムキット HB-V01+ACC シルバー

新品 未使用】AQUANODEプレミアムキット 水素水生成器 ブラウンの通販

カドー 水素生成器 ハンディボトル アクアノード 120ml シルバーの+

未使用】AQUANODE アクアノード 水素水生成器 水素水 HB-V01 www

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています