明元素(栄養補助食品)

(税込) 送料込み

商品の説明

詳しい内容は写真で見てください!!

します!

新品です!商品の情報

| カテゴリー | コスメ・香水・美容 > その他 > 健康用品 |

|---|---|

| 商品の色を | イエロー系 / ベージュ系 / グレイ系 |

| 商品の状態 | 新品、未使用 |

明元素【栄養補助食品】⭐︎定価45000円今なら10000円引きで35000円

楽天市場】 サプリメント・健康食品 > 健康補助食品・サプリメント

明元素(120粒) めいげんそ DHA EPA スッポン マグロ魚油 ビオチン 凍結粉砕 スッポンオイル すっぽん加工食品 サプリ 健康食品

明元素(120、360粒) – 株式会社フカイ│岡山県、広島県の配置薬

明元素(120粒) めいげんそ DHA EPA スッポン マグロ魚油 ビオチン 凍結粉砕 スッポンオイル すっぽん加工食品 サプリ 健康食品

明元素【栄養補助食品】⭐︎定価45000円今なら10000円引きで35000円

明元素(120粒) めいげんそ DHA EPA スッポン マグロ魚油 ビオチン 凍結粉砕 スッポンオイル すっぽん加工食品 サプリ 健康食品

すっぽん加工食品 栄養補助食品 健康維持 明元素❣️+spbgp44.ru

楽天市場】 サプリメント・健康食品 > 健康補助食品・サプリメント

すっぽん加工食品 栄養補助食品 健康維持 明元素❣️+spbgp44.ru

くすりと酵素酢の健康学園 - 健康補助食品(サプリメント・健康食品

免疫力を上げる! - 三枝薬房

DHC亚铅酵母补充锌元素精神好食欲大增-美国-日本代购直邮- Hommi

《セット販売》 大塚製薬 ネイチャーメイド 亜鉛 60日分 (60粒)×3個セット 栄養機能食品 ※軽減税率対象商品

すっぽん加工食品 栄養補助食品 健康維持 明元素❣️+spbgp44.ru

製品一覧|製品情報|株式会社クリニコ

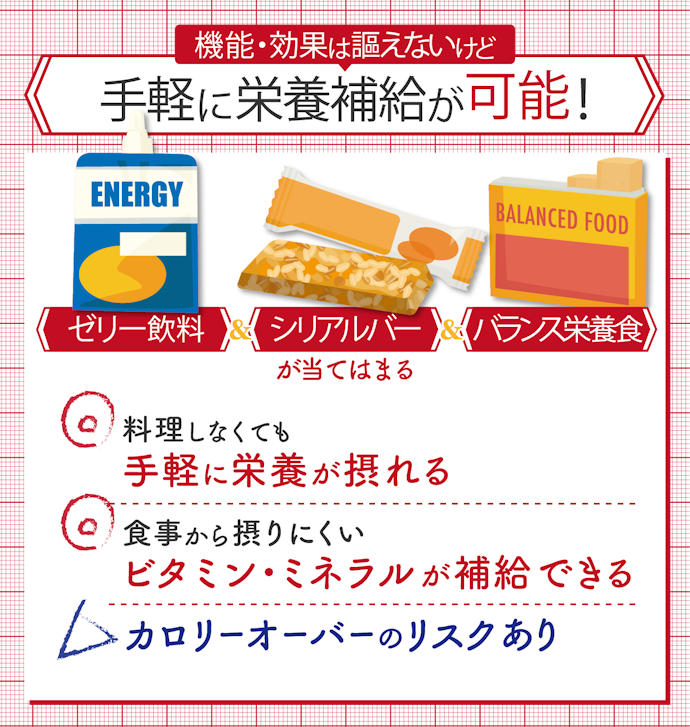

比べてみたら>栄養補助食品:東京新聞 TOKYO Web

健康食品/營養補品> サプリ/營養輔助食品- 大國藥妝

置き薬の株式会社ミズノ常備薬<商品紹介>

介護食・流動食 | 森永乳業の通信販売【公式】

楽天市場】 サプリメント・健康食品 > 健康補助食品・サプリメント

昆昱,昆昱國際有限公司,健康食品,保健食品,維他命錠,奶粉- 昆昱國際

栄養補助食品|製品情報|株式会社クリニコ

【栄養補助飲料】明治メイバランスMini 125ml 8種類セット 【HLS_DU】【3980円以上購入で送料無料】【介護食品 メイバランスミニ 明治 介護 ドリンク 栄養補助 介護飲料 高カロリー カロリー補助 栄養補給】-介護食品専門店 ももとせ本店

健之概念】視晶明極萃綠蜂膠葉黃素EX+B鋅膠囊

日本直邮】乐敦最新研发the lypo人工膜维生素C胶囊打造肌肤透明感持续

S-SELECT】瑪卡maca 30日分90粒– スギSUGI ONLINE SHOP

人気の栄養補助食品おすすめ11選 - OZmall

メイバランス Miniカップ 11種類×各5本 明治 介護 高齢者 飲料

介護食・流動食 | 森永乳業の通信販売【公式】

明治メイバランスソフトJelly|栄養ケア倶楽部|株式会社 明治

経口栄養補助食品

昆昱,昆昱國際有限公司,健康食品,保健食品,維他命錠,奶粉- 昆昱國際

2023年】栄養補助食品のおすすめ人気ランキング57選 | mybest

明治 メイバランスミニ 詰合わせ-栄養補助飲料-ビースタイル

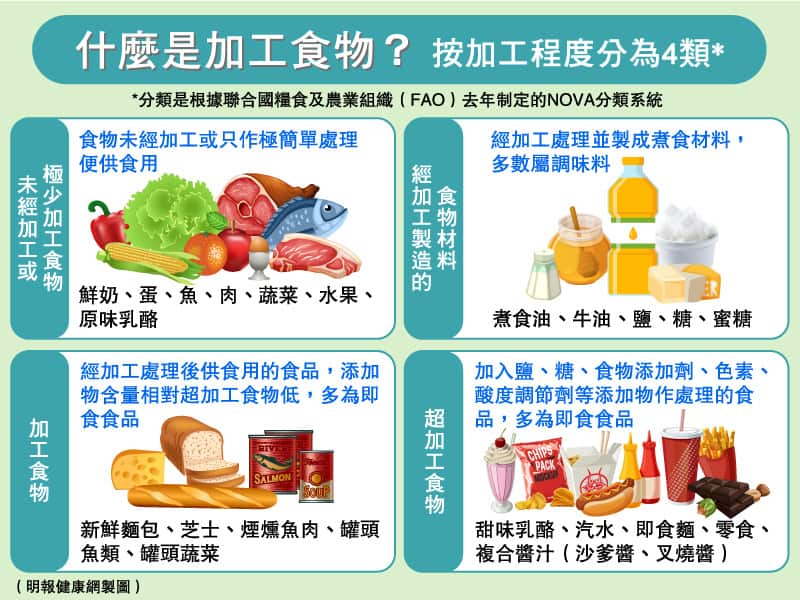

超加工食物是美味的健康殺手?4類加工食物你要識營養師教你選擇4個貼士

栄養補助食品 | 販売商品 | 株式会社マルイチ薬局

保健/腸胃保健- 日本大阪KUWA 免稅店kuwa osaka 日本妙利散

比べてみたら>栄養補助食品:東京新聞 TOKYO Web

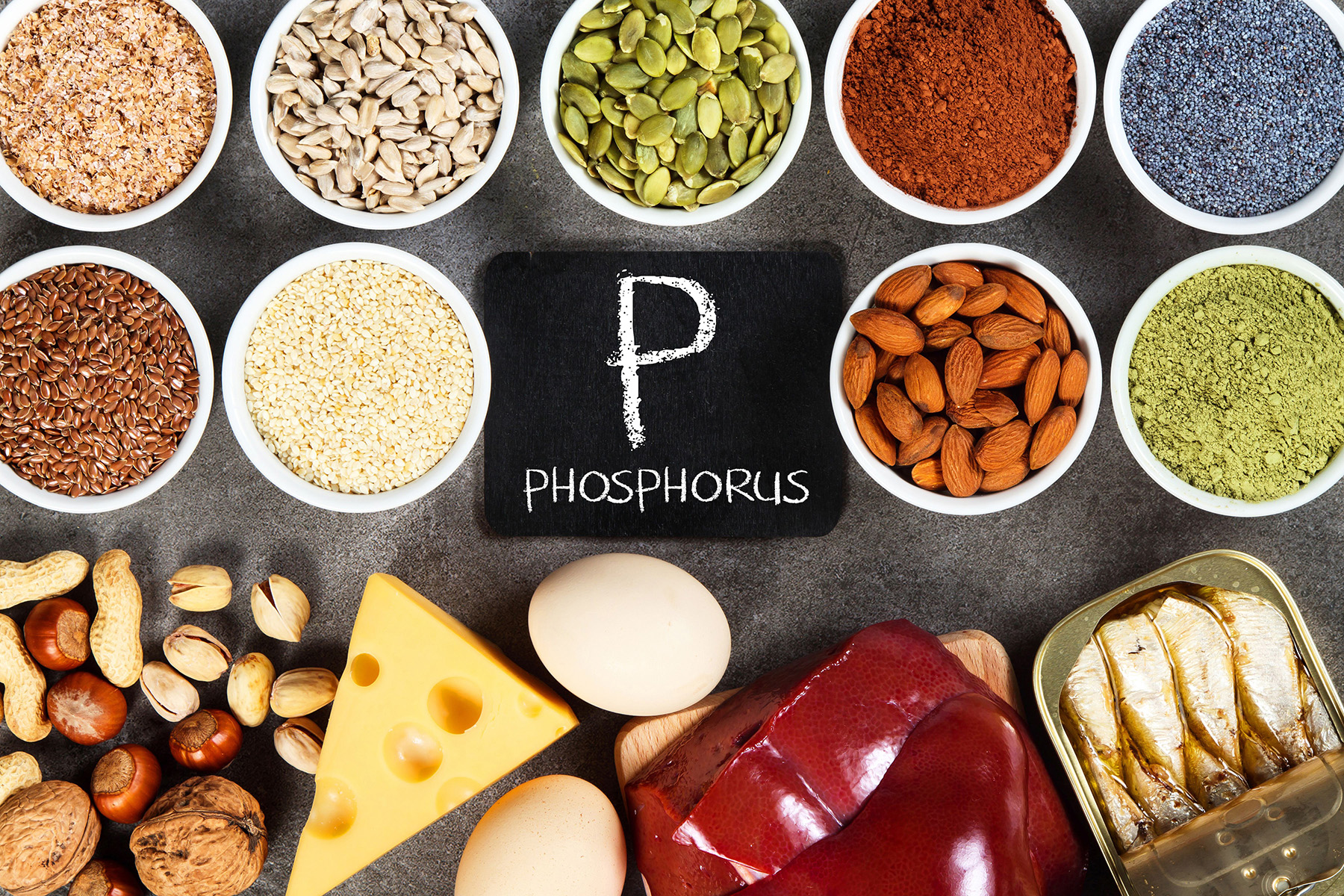

リン」とは?主な働きや含まれる食べ物、一日の摂取量について解説

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています