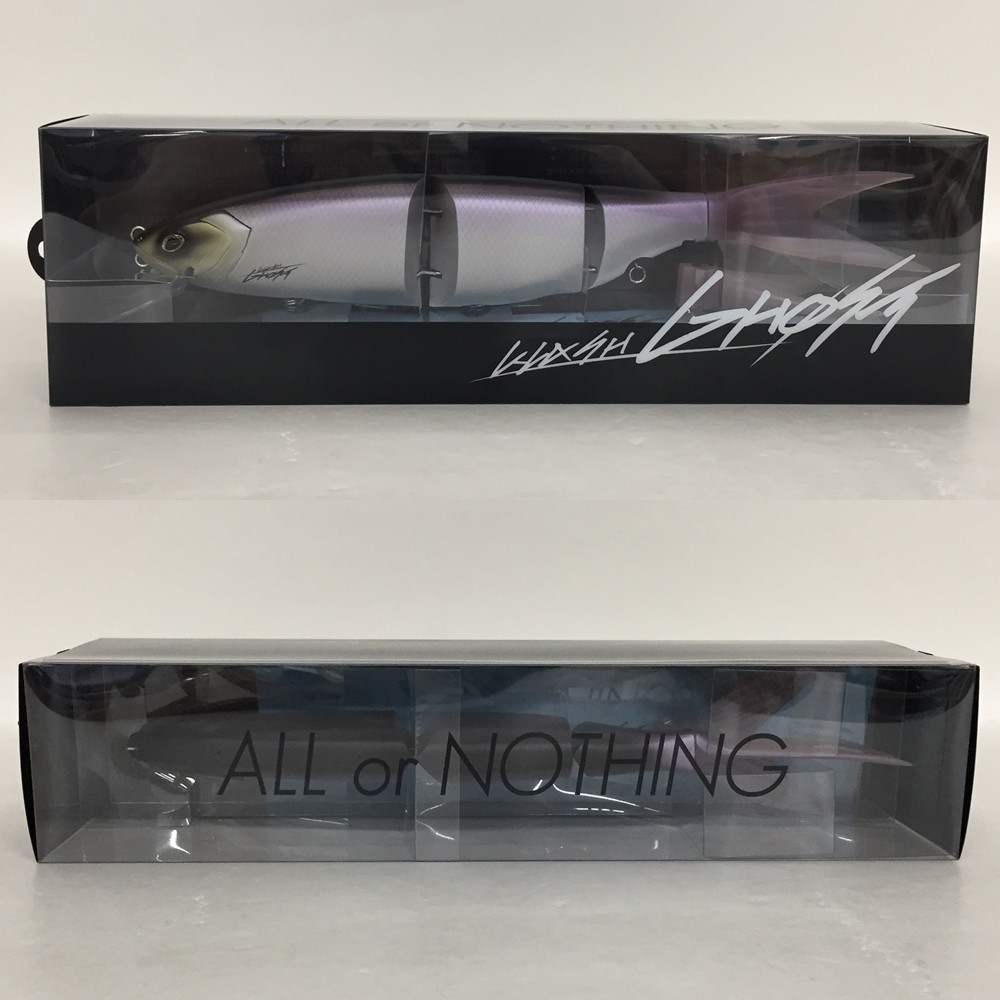

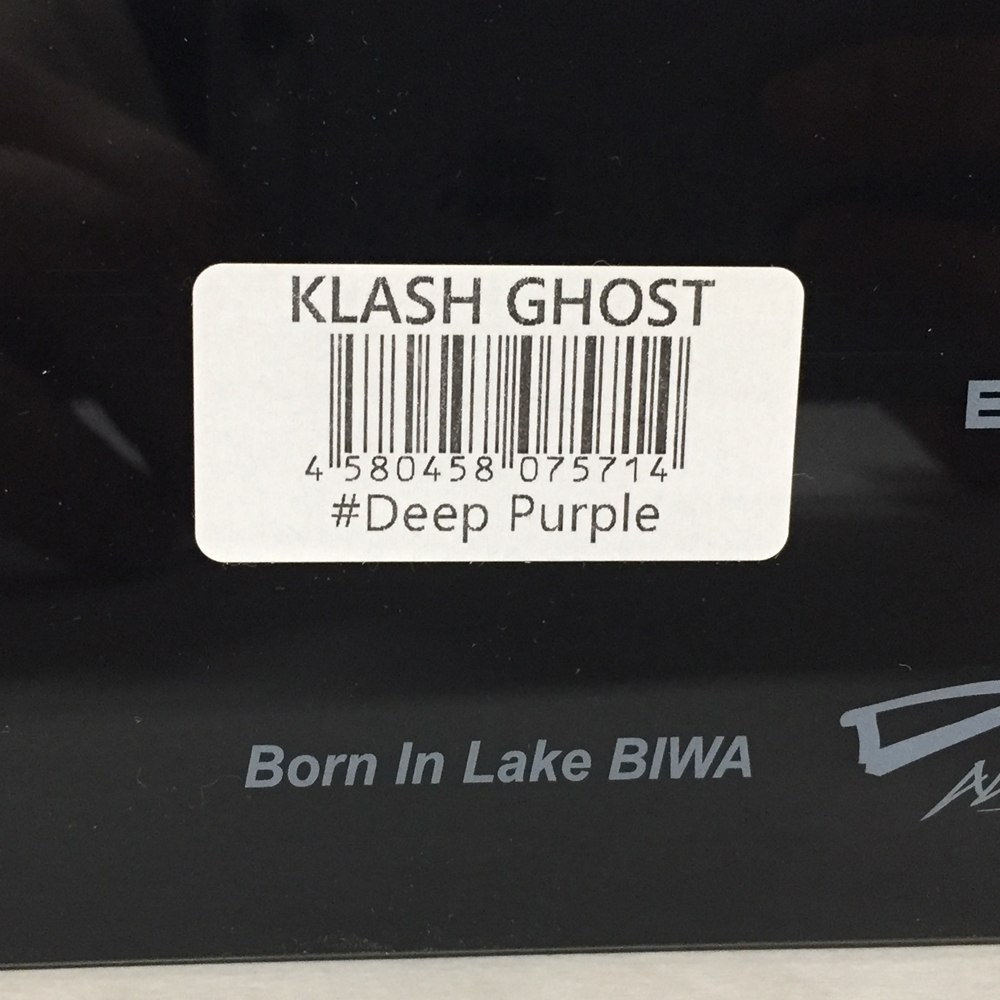

新品未使用 DRT クラッシュゴースト #Deep Purple ビッグベイト

(税込) 送料込み

商品の説明

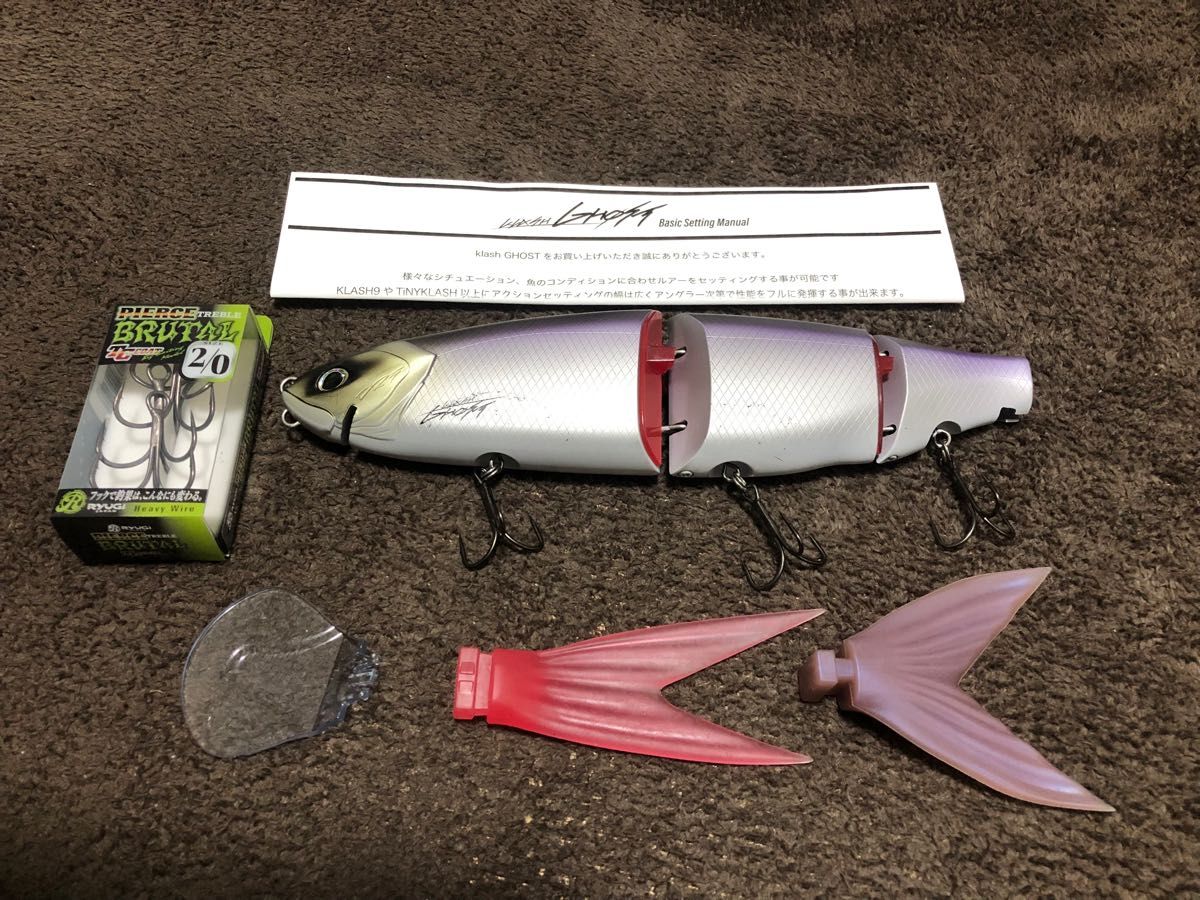

DRTのクラッシュゴーストです☆

購入後は自宅で大切に保管して飾っていました。

新品未使用品になります。

カラーは#Deep Purpleです。

別売りのDRT ORIGINAL TREBLE HOOK(トレブルフック)#1(4本入)もお付けします。

こちらも新品未使用です。

購入した時から箱に少し凹みがありますが(写真5枚目)、ルアーには全く問題ありません。

新しい家族が出来て、釣りに行く機会も減りましたので、出品します。

釣種/魚種···バス/ブラックバス

ルアー/フライ種類···ビッグベイト商品の情報

| カテゴリー | スポーツ・レジャー > フィッシング > ルアー用品 |

|---|---|

| 商品の状態 | 新品、未使用 |

24時間以内発送】 【新品未使用】クラッシュゴースト KLASH GHOST DRT

売り人気 新品未使用 DRT クラッシュゴースト #Deep Purple ビッグ

楽天市場】DRTクラッシュゴースト #ディープパープルKLASH GHOST #Deep

売り人気 新品未使用 DRT クラッシュゴースト #Deep Purple ビッグ

クラッシュゴースト ディープパープル DRT klashghost purple-

DRT クラッシュ9 Deep Purple-

Yahoo!オークション -「deep purple」(淡水) (ハードルアー)の落札相場

クラッシュゴースト ディープパープル DRT klashghost purple-

DRT クラッシュゴースト ディープパープル - ルアー用品

24時間以内発送】 【新品未使用】クラッシュゴースト KLASH GHOST DRT

DRT クラッシュ9 Deep Purple-

ラッピング不可】 DRT TINYKLASH オリカラ タイニークラッシュ ビッグ

SALE/55%OFF】 新品未開封 drt タイニークラッシュ ボンバダアグア

Yahoo!オークション -「deep purple」(淡水) (ハードルアー)の落札相場

新しいコレクション Mid クラッシュ9 SUPLEX DRT ∞送料無料

最も 限定 DRT TOKYO ANGLERS MAYDAY フルコンプリート ゴースト

SALE/37%OFF】 DRT◇ルアー ビッグベイト - thedreamteamnetwork.com

売れ筋介護用品も! FLカラー Low タイニークラッシュ 【DRT】 DRT

DRT クラッシュ9 Deep Purple-

KLASH GHOSTのYahoo!オークション(旧ヤフオク!)の相場・価格を見る

売り人気 新品未使用 DRT クラッシュゴースト #Deep Purple ビッグ

楽天市場】DRTクラッシュゴースト #ディープパープルKLASH GHOST #Deep

DRT クラッシュゴースト klash ghost DEEP Purple-

Yahoo!オークション -「deep purple」(淡水) (ハードルアー)の落札相場

幸せなふたりに贈る結婚祝い 新品 ディビジョン drt クラッシュ9 LOW

楽天市場】DRTクラッシュゴースト #ディープパープルKLASH GHOST #Deep

売り人気 新品未使用 DRT クラッシュゴースト #Deep Purple ビッグ

DRT クラッシュ9 Deep Purple-

ベビーグッズも大集合 2020年製 20S レジディ 龍 遠藤ルアー 【ウッド

Yahoo!オークション -「(紫 パープル)」(ビッグベイト) (淡水)の落札

楽天市場】DRTクラッシュゴースト #ディープパープルKLASH GHOST #Deep

DRT クラッシュゴースト klash ghost DEEP Purple-

新到着 ノリーズ ヒラクランクギル110F 未使用 無料発送 チャート

在庫限り】 ガンクラフト ジョインテッドクロー ラチェット 金鯱

DRT クラッシュ9 Deep Purple-

全国宅配無料 イマカツ レイジーハード ナチュラル砂喰鮎 #483 ビッグ

オールドヘドン ビッグタイガーBB tienda.purifru.com.py

クラッシュゴースト ディープパープル ライザージャック xxtraarmor.com

Yahoo!オークション -「deep purple」(淡水) (ハードルアー)の落札相場

DRT クラッシュ9 tienda.purifru.com.py

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています