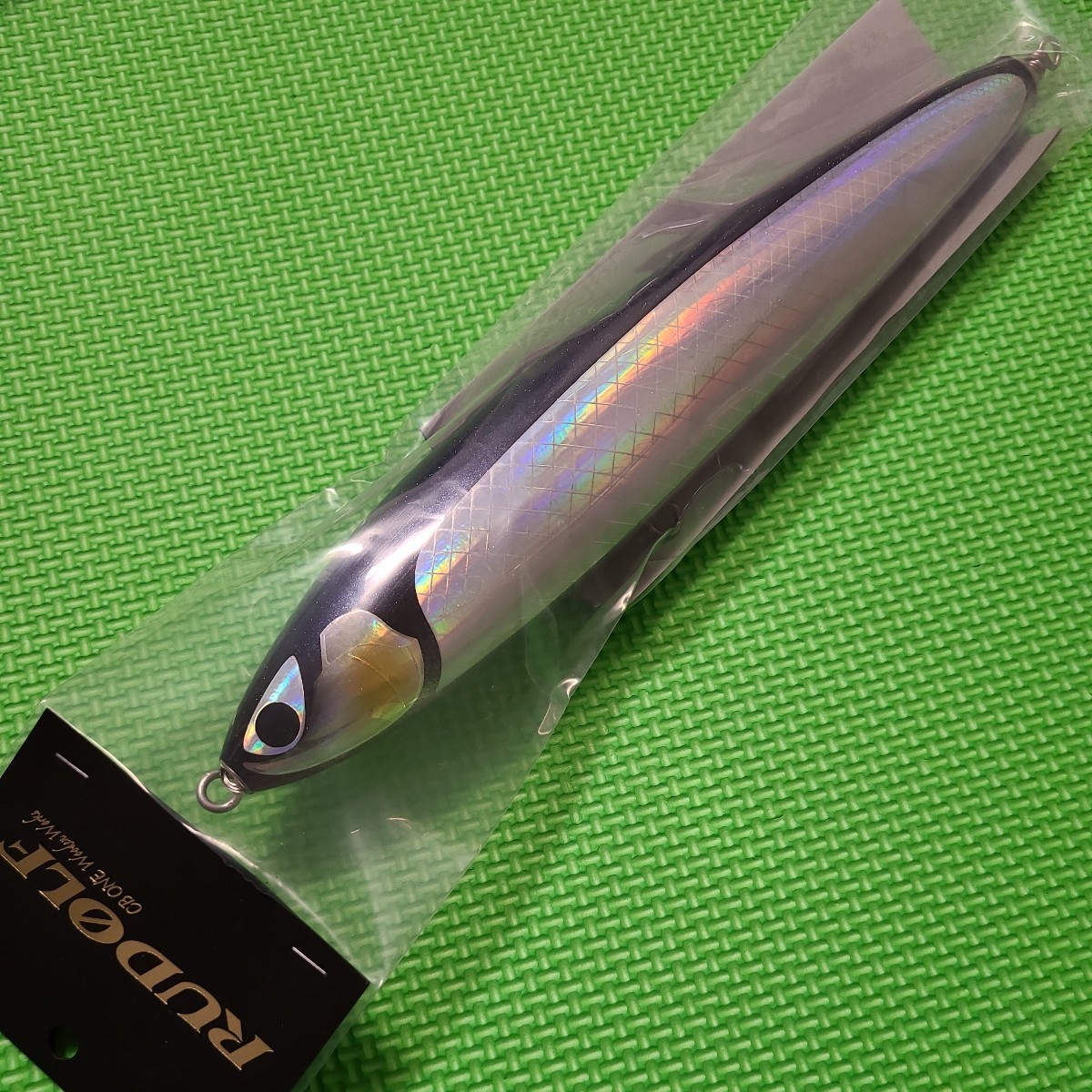

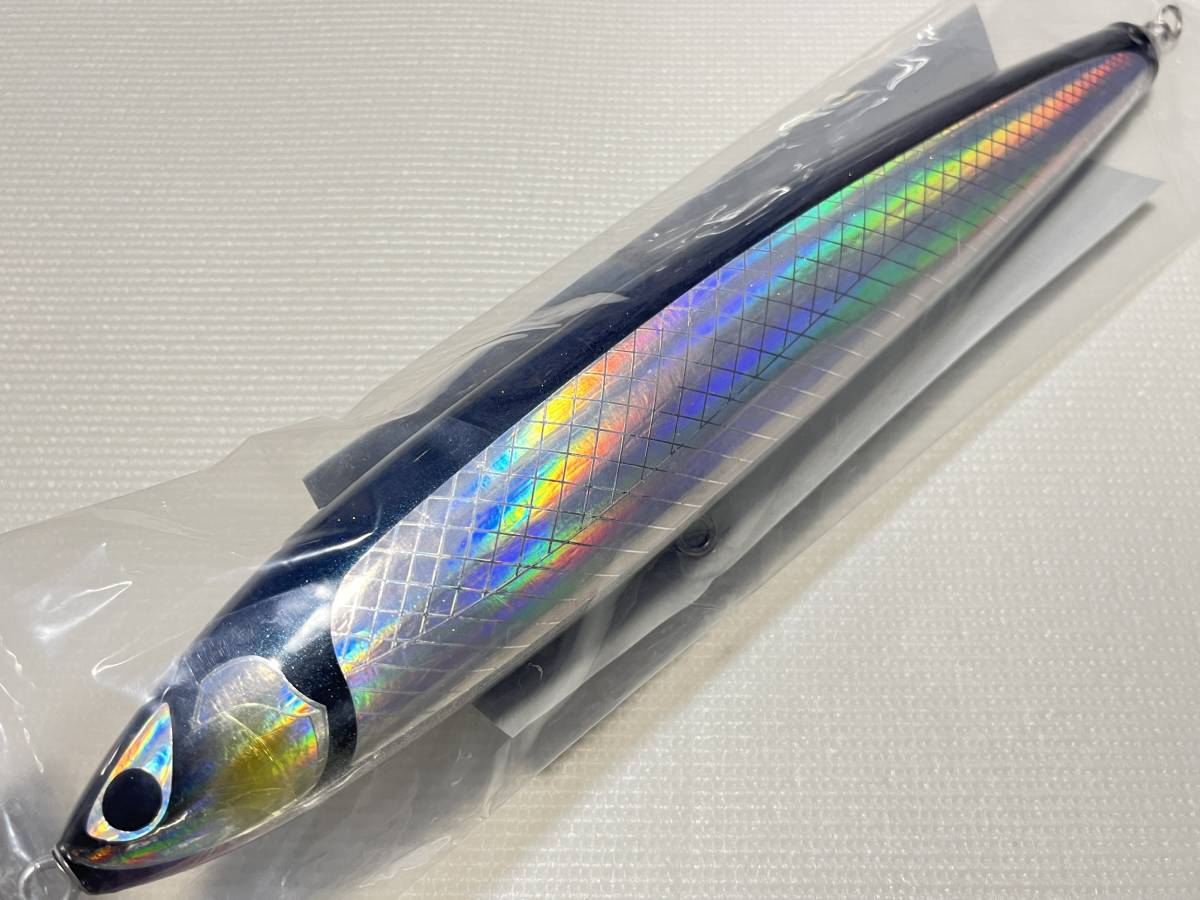

新品 CB ONE RUDOLF300 ルドルフ300 シービーワン

(税込) 送料込み

商品の説明

新品 CB ONE RUDOLF300

ルドルフ300 シービーワン

♡自宅保管品♡

即決優先で専用にはしません(*´꒳`*)

離島の方は購入前にお声掛け下さい。

必ずプロフィールを見て下さい。

納得された方のみお願いします。

その他、多数出品中

宜しくお願いします!

ビーコン バブルス マリノ

ディークロウ

ビーコン

トランペット

貝田ルアー

BAZOO バズー スリム

シービーワン CBONE

シマノ オシア フラッシュブースト

ダイワ マリア ラピード マリノ

ソウルズ ハンマーヘッド シャラポワ

カーペンター ガンマ ブルーフィッシュ

ストライクイーグル BCポッパー

舞姫 歌姫 バブルス 別注平政 マグロ

タックルハウス デカゲロオスギ

ダムセル サートポップ ヒラマサ

アワビ 鮑 猛闘犬丸 KLL ソルティガ

シマノ SHIMANO ダイワ Daiwa

オシア フルスロットル リミテッド

ソルティガ オーシャンズ

カーペンター CBONE MCワークス

ソウルズ ヤマガブランクス

ブルースナイパー グラップラー

アブガルシア パッションズ ホーク

天龍 オシアプラッガー ブルーチェイサー

ウルティモ ワールドシャウラ シーレパード

BLC SLP ゼナック アクイラ

好きな方にもオススメです♡商品の情報

| カテゴリー | スポーツ・レジャー > フィッシング > ルアー用品 |

|---|---|

| 商品の状態 | 新品、未使用 |

新品 CB ONE RUDOLF300 ルドルフ300 シービーワン-

新品 CB ONE RUDOLF300 ルドルフ300 シービーワン-

新品 CB ONE RUDOLF300 ルドルフ300 シービーワン-

2023年最新】Yahoo!オークション -cbone ルドルフ(ルアー用品)の中古品

2023年最新】Yahoo!オークション -cbone ルドルフの中古品・新品・未

送料無料】シービーワン ルドルフ 300 偏光ブルー / CBONE RUDOLF

フィッシングCB-ONE RUDOLF シービーワン ルドルフ300 未使用品

SALE中) 新品 CB ONE RUDOLF300 ルドルフ300 シービーワン ルアー用品

フィッシングCB-ONE RUDOLF シービーワン ルドルフ300 未使用品

新品☆CB ONE☆RUDOLF☆300☆ルドルフ☆シービーワン

CB one ルドルフ300 シービーワン 沸騰ブラドン 16170円引き

CB ONE Rudolf 300 Wooden Stick Bait

CB one ルドルフ300 シービーワン - ルアー用品

CB−ONE RUDOLF シービーワン ルドルフ300 ヒラマサ GT

SALE中) 新品 CB ONE RUDOLF300 ルドルフ300 シービーワン ルアー用品

CB one ルドルフ300 シービーワン - ルアー用品

新品☆CB ONE☆RUDOLF☆300☆ルドルフ☆シービーワン

Sản phẩm CB-ONE シービーワン RUDOLFルドルフ 300 ホログラム/偏光

CB ONE Rudolf 300 Wooden Stick Bait

Sản phẩm CB-ONE シービーワン RUDOLFルドルフ 300 ホログラム/偏光

CB one ルドルフ300 シービーワン - ルアー用品

新品☆CB ONE☆RUDOLF☆300☆ルドルフ☆シービーワン☆-

☆CB-ONE☆RUDOLF☆シービーワン☆ルドルフ300☆未使用品☆ - フィッシング

上品】 シービーワン ルドルフ300 ルアー用品 pablovarela.com

2023年最新】Yahoo!オークション -cbone ルドルフの中古品・新品・未

CB ONE Rudolf 300 Wooden Stick Bait

新品 CB ONE RUDOLF300 ルドルフ300 シービーワン - ルアー用品

CB ONE ルドルフ300 シービーワン 新品未開封 検)カーペンター MC

新品☆CB ONE☆RUDOLF☆300☆ルドルフ☆シービーワン 【値下げ】 49.0

人気No.1】 シービーワン ルドルフ 300 ホログラム/偏光ブルー・CB-ONE

上品】 シービーワン ルドルフ300 ルアー用品 pablovarela.com

CB ONE Rudolf 300 Wooden Stick Bait

新品 CB ONE RUDOLF300 ルドルフ300 シービーワン-

CB ONE

シービーワン ルドルフ300-

人気No.1】 シービーワン ルドルフ 300 ホログラム/偏光ブルー・CB-ONE

CB ONE

新品 CB ONE RUDOLF300 ルドルフ300 シービーワン-

HEDDON #300 4inch 【超ポイント祭?期間限定】 18865円引き

新品 CB ONE RUDOLF300 ルドルフ300 シービーワン-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています