蓮梅mama様確認画面 マタニティパンツ 無印良品

(税込) 送料込み

商品の説明

◎濃いベージュ 予定

無印良品のマタニティパンツです。

仕事や私服に使いました。

履き心地が良く、愛用していたので使用感あります。

左膝が少しスレているような感じがあります。

私的には写真が実際よりひどく写っていると感じます。

実物は気になるかな?程度と感じます。

◎薄いベージュ 予定

同じく無印良品のマタニティパンツです。

こちらは色が好きだったので、濃いベージュより愛用しました。

同じく履き心地が良かったです。

濃いベージュと同じようになぜか左膝がスレているように写りました。

こちらも私的には気にならない程度かと思います。

どちらも中古となりますのでご了承ください。

あくまでも私的にはという話で感じ方等はそれぞれかと思いますので、その辺はご理解ください。

13日から実家に帰省しますので、発送は20日以降となります。商品の情報

| カテゴリー | レディース > マタニティ > パンツ/スパッツ |

|---|---|

| 商品のサイズ | L |

| ブランド | 無印良品 |

| 商品の色を | ブラウン系 / オレンジ系 |

| 商品の状態 | やや傷や汚れあり |

無印 ミルクティー エンジェリーベ マタニティパンツ レギンス7点

無印 ミルクティー エンジェリーベ マタニティパンツ レギンス7点

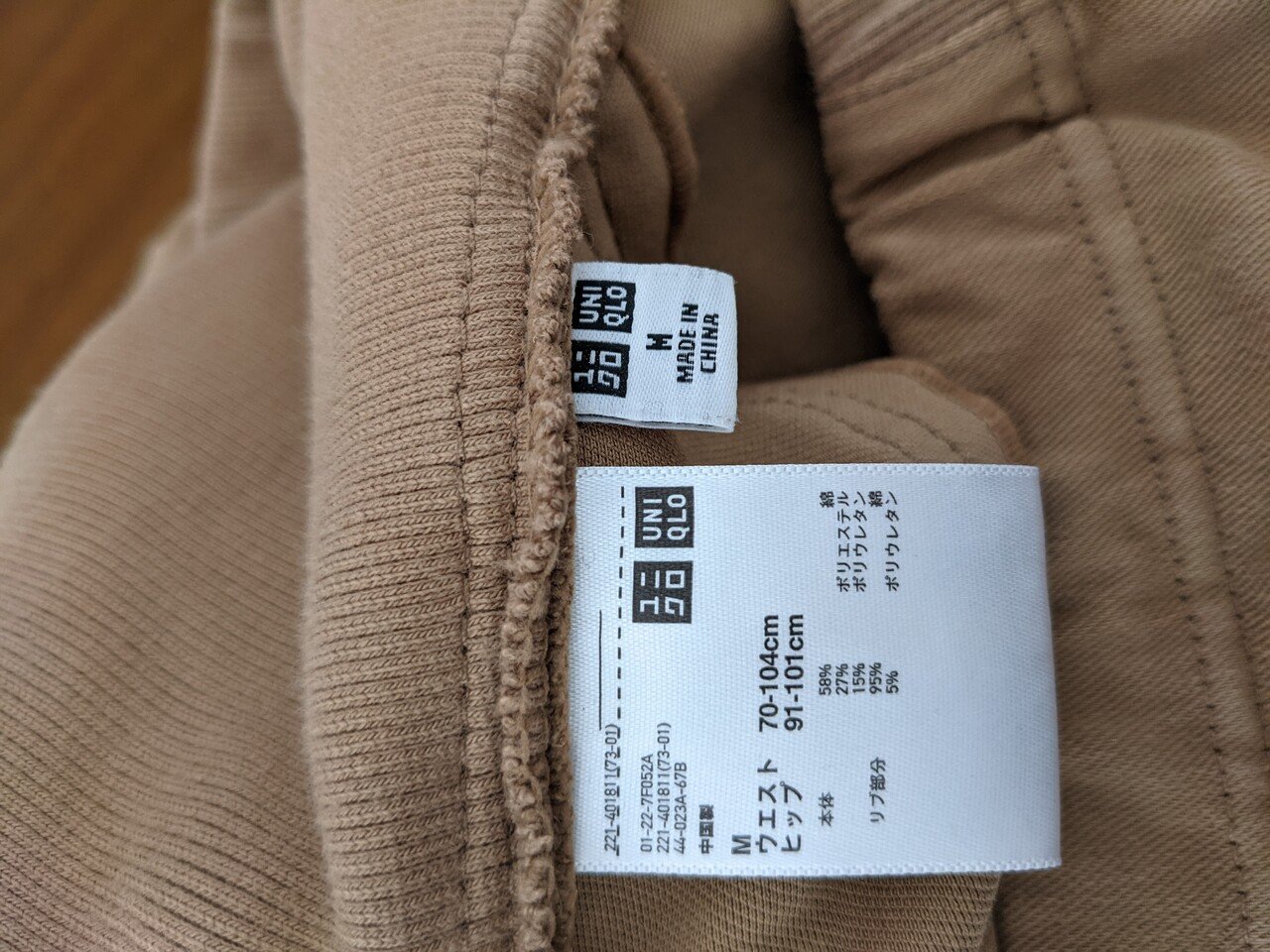

ユニクロと無印良品のマタニティパンツの履き比べ【妊娠記録】|神田

ユニクロと無印良品のマタニティパンツの履き比べ【妊娠記録】|神田

楽天市場】【新作】マタニティ スーツ パンツ 通勤 通勤パンツ 裏起毛

ドラゴンボール カードダス 1988年製 ① 孫悟空 - ドラゴンボール

MUJI (無印良品) - リネン マタニティ ガウチョパンツの通販 by とっ

ユニクロと無印良品のマタニティパンツの履き比べ【妊娠記録】|神田

ナルミ、ナカヤマ、コペンハーゲン 最低価格販売 nuves.com.sv

マタニティパンツ比較 UNIQLO vs 無印良品 | 5歳差♡オシャレに効率

MUJI (無印良品) - ストレッチ裏フリース 産後もはける レギンスパンツ

マタニティ | 婦人服・レディースウェア 通販 | 無印良品

マタニティレギンス「ユニクロ」と「無印」どっちがいい? - 楽しく生きろ

マタニティパンツ比較 UNIQLO vs 無印良品 | 5歳差♡オシャレに効率

マタニティ | 婦人服・レディースウェア 通販 | 無印良品

現行品】サンローラン SAINT LAURENT PARIS パーカー ピンク 810810.co.jp

【産前・産後】モニターママと検証しました!おなからくちんマタニティパンツ

ユニクロと無印良品のマタニティパンツの履き比べ【妊娠記録】|神田

無印良品☆マタニティパンツ - パンツ

無印良品のマタニティが人気の理由 レギンス・パジャマ・デニムなど

MUJI (無印良品) - ストレッチ裏フリース 産後もはける レギンスパンツ

楽天市場】【新作】マタニティ スーツ パンツ 通勤 通勤パンツ 裏起毛

Hikvision DS-2DE2A404IW-DE3 810810.co.jp

無印良品のマタニティ期におすすめアイテム7選!オーガニックコットン

![Amazon.co.jp: [Angemy] マタニティパンツ 【助産師監修】 まるで](https://m.media-amazon.com/images/I/51cRaYi0irL._AC_SL1500_.jpg)

Amazon.co.jp: [Angemy] マタニティパンツ 【助産師監修】 まるで

無印良品のマタニティウェア 口コミ | ママリ口コミ大賞

産前・産後】らくちんでキレイ見え マタニティセンタープレスパンツ

無印良品のマタニティが人気の理由 レギンス・パジャマ・デニムなど

2023年最新】無印 マタニティの人気アイテム - メルカリ

無印良品のマタニティ期におすすめアイテム7選!オーガニックコットン

犬印本舗 マタニティパンツ 産前産後兼用 涼感 らくちん ストレッチ

MUJI (無印良品) - リネン マタニティ ガウチョパンツの通販 by とっ

ユニクロと無印良品のマタニティパンツの履き比べ【妊娠記録】|神田

産前・産後】らくちんでキレイ見え マタニティセンタープレスパンツ

無印良品のマタニティが人気の理由 レギンス・パジャマ・デニムなど

楽天市場】\送料無料/ マタニティ レギンス パンツ 裏起毛 裏ボア

マタニティパンツ比較 UNIQLO vs 無印良品 | 5歳差♡オシャレに効率

マタニティレギンス「ユニクロ」と「無印」どっちがいい? - 楽しく生きろ

マタニティ | 婦人服・レディースウェア 通販 | 無印良品

無印良品のマタニティウェア 口コミ | ママリ口コミ大賞

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています